Singapore Corporate Tax Rate

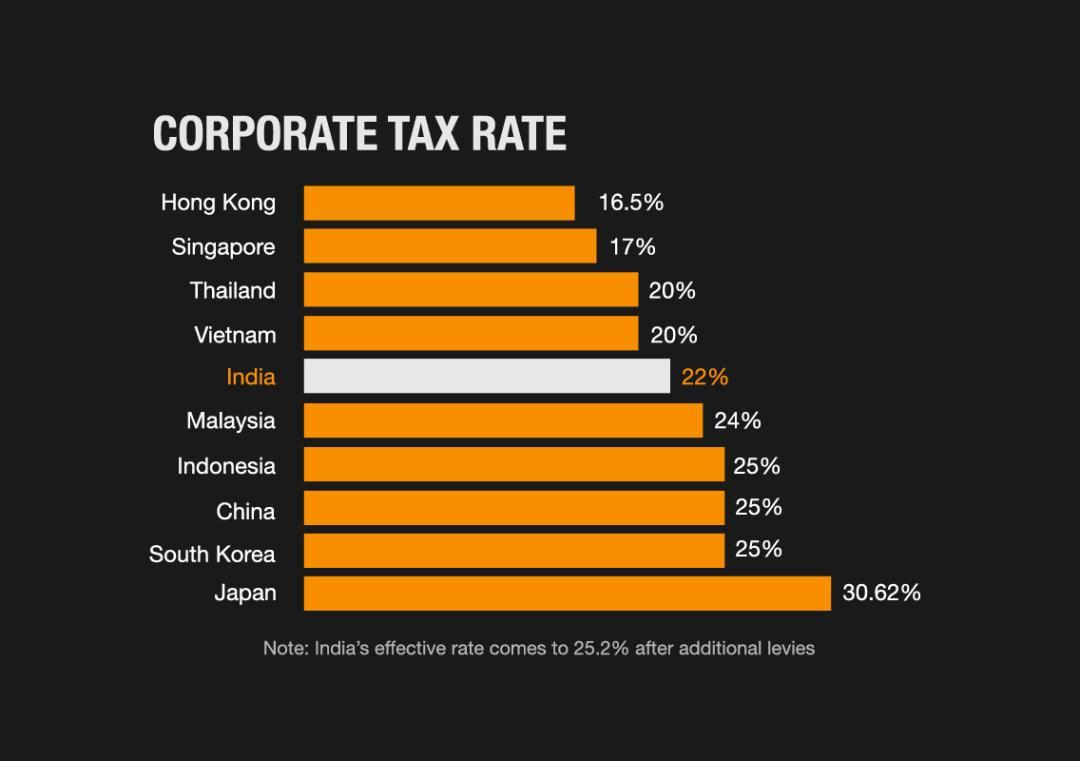

2013 and subsequent yas. Corporate income tax 3 singapore companies indulging in international transactions currently enjoy benefits from double tax avoidance dta treaties with more than 80 countries.

Why Invest In India Through A Singapore Company Rikvin Pte Ltd

Why Invest In India Through A Singapore Company Rikvin Pte Ltd

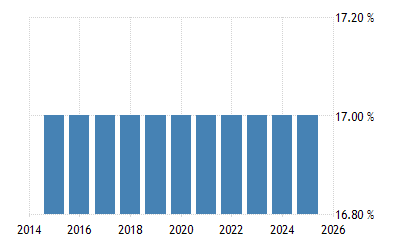

Corporate tax rate in singapore averaged 20 04 percent from 1997 until 2020 reaching an all time high of 26 percent in 1998 and a record low of 17 percent in 2010.

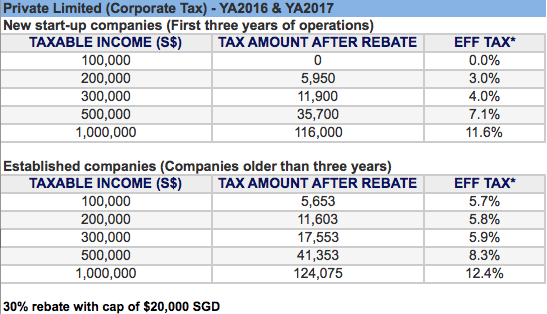

Singapore corporate tax rate. In 2020 the government announced that all companies will be granted a 25 corporate income tax rebate that is subject to an annual cap of s 15 000. This ultimately brings down the effective tax rate. The headline corporate tax rate of 17 is further reduced by various tax exemptions and incentives.

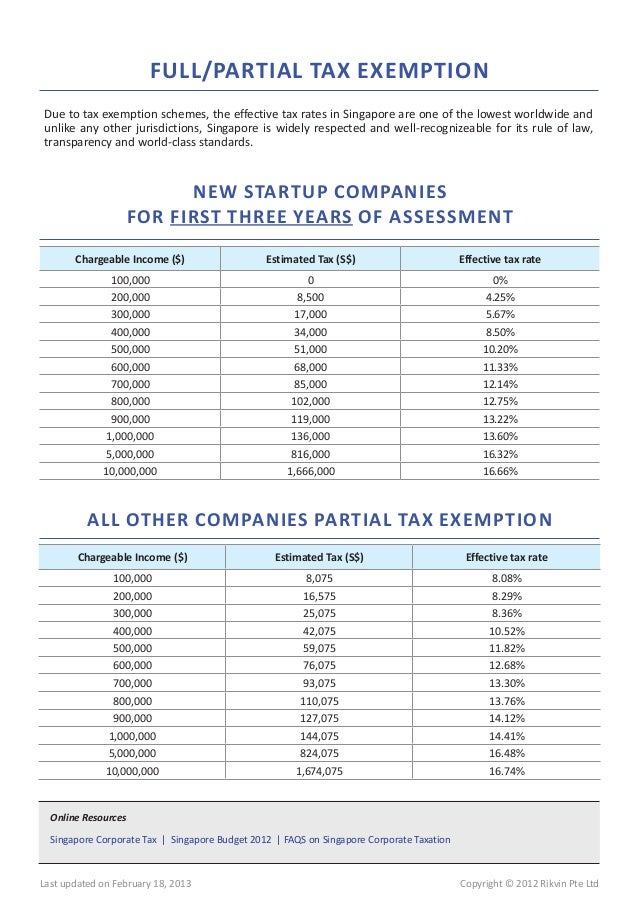

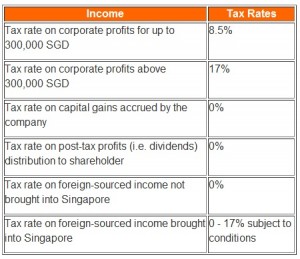

1997 00 2001 2002 2003 04 2005 06 2007 09 from 2010. Tax on corporate income is imposed at a flat rate of 17. Companies can enjoy the partial tax exemption and tax exemption for new start up companies as provided in the tables below.

Singapore corporate tax is levied at a flat rate of 17 on chargeable income. The list of beneficiaries of this new scheme even include registered business trusts non tax resident companies in singapore and companies already receiving income taxed at a concessionary tax rate. The corporate tax rate in singapore stands at 17 percent.

The corporate income tax rate in singapore is a flat 17. Partial tax exemption for companies from ya 2020. The place where management and control is exercised generally is the place where the directors meetings are held.

Corporate income tax rate 17 branch tax rate 17 capital gains tax rate 0 residence a company is resident in singapore for income tax purposes if the management and control of its business is exercised in singapore. Singapore s headline corporate tax rate is a flat 17. And b certain entities that are not required to file eci.

Interest royalties technical service fees rental of movable property where these are deemed to arise in singapore for details see the withholding taxes section. This page provides singapore corporate tax rate actual values historical data forecast chart statistics economic calendar and news. In order to make singapore as an attractive investment destination income tax rates in singapore have been going down consistently as seen below.

Non residents are subject to withholding tax wht on certain types of income e g. Corporate income tax cit rebate. Estimated chargeable income eci within three months from the company s financial year end except for a companies that fulfil the conditions under the administrative concession.

All companies need to submit two corporate income tax returns to iras every year. What is the corporate tax rate in singapore. And corporate income tax returns commonly known as form c s or form c by.

However the effective corporate tax rate could be lowered by other incentives introduced by the inland revenue authority of singapore. Partial tax exemption and tax exemption scheme for new start up companies. A company can calculate its chargeable income by taking its taxable revenues any ongoing or recurring source of income derived from singapore or remitted into singapore and subtracting deductible expenses.

India Slashes Corporate Taxes In Multibillion Dollar Growth Bid

India Slashes Corporate Taxes In Multibillion Dollar Growth Bid

Source Karaian Jason Hungary Is Cutting Its Corporate Tax Rate

Source Karaian Jason Hungary Is Cutting Its Corporate Tax Rate

Will India S Experience With Corporate Tax Cuts Be Different From

Will India S Experience With Corporate Tax Cuts Be Different From

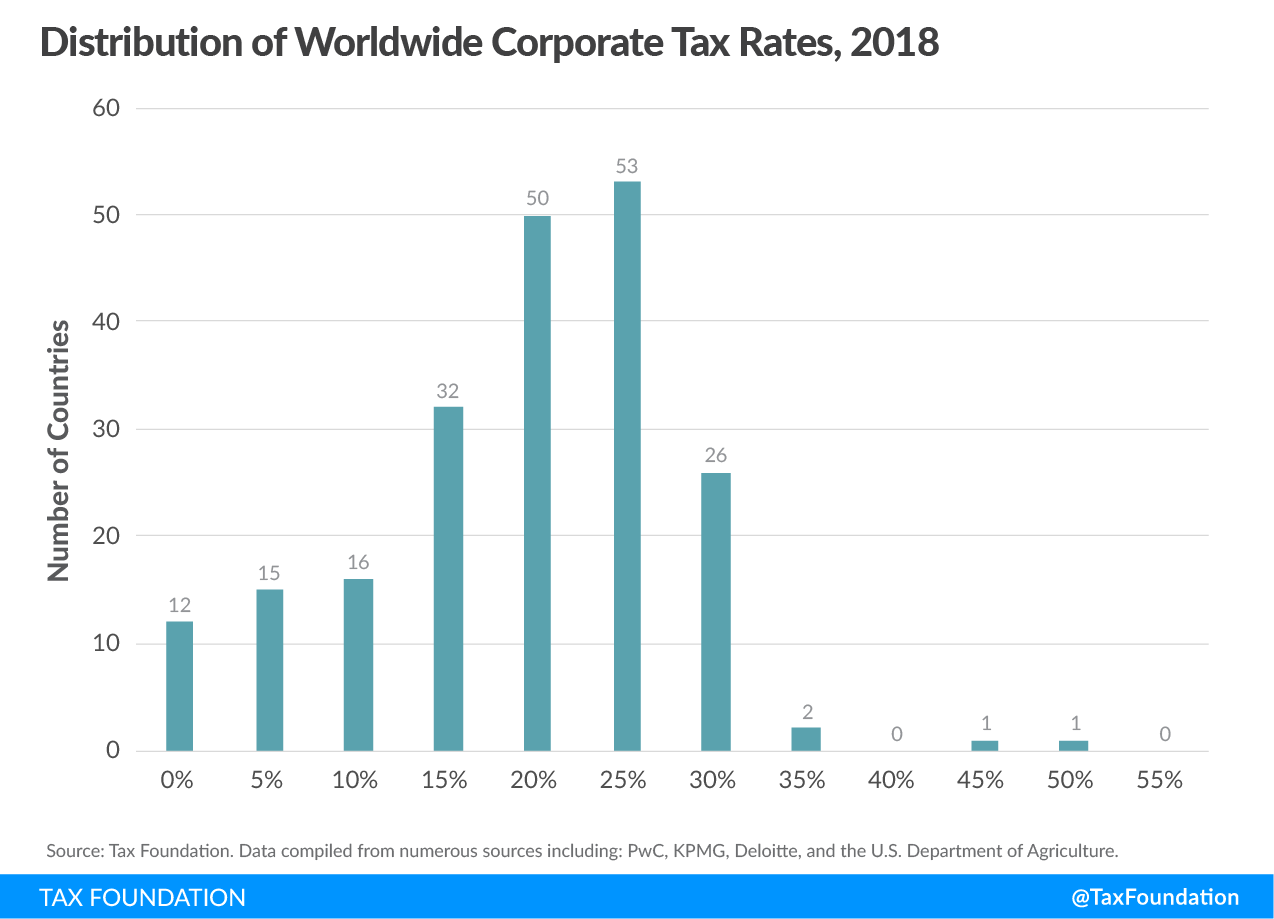

Corporate Tax Rates Around The World Tax Foundation

Corporate Tax Rates Around The World Tax Foundation

Singapore Corporate Tax Rates 2013

Singapore Corporate Tax Rates 2013

Singapore Corporate Tax 2020 Guide Taxable Income Tax Rates

Singapore Corporate Tax 2020 Guide Taxable Income Tax Rates

Lowest Corporate Tax Among Asean Countries Attract Foreign

Lowest Corporate Tax Among Asean Countries Attract Foreign

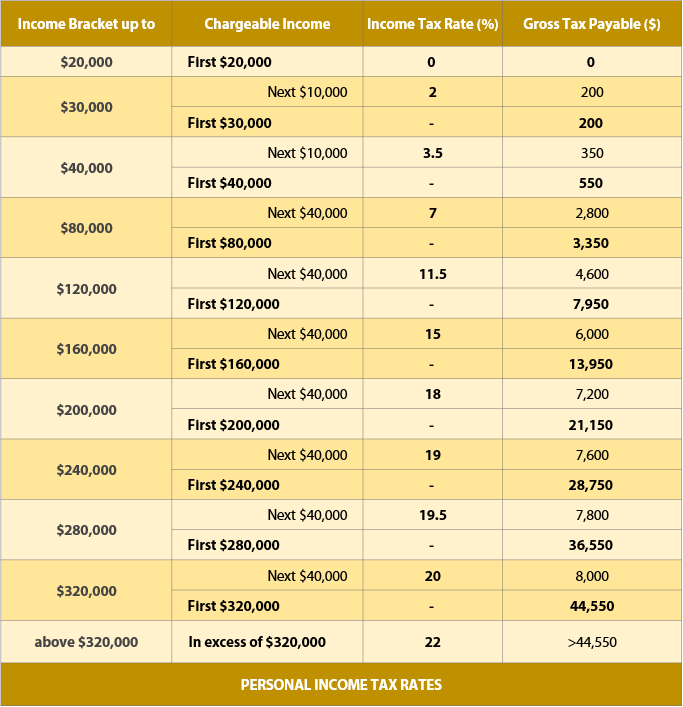

Singapore Personal Individual Income Tax Rate Singapore 2017 And 2018

Singapore Personal Individual Income Tax Rate Singapore 2017 And 2018

Don S Column Singapore Corporate Tax Rate

Don S Column Singapore Corporate Tax Rate

The Budget Should Cut Corporate Tax Rates Drastically

The Budget Should Cut Corporate Tax Rates Drastically

Personal Income Tax Rates For Singapore Tax Residents Ya 2020

Personal Income Tax Rates For Singapore Tax Residents Ya 2020

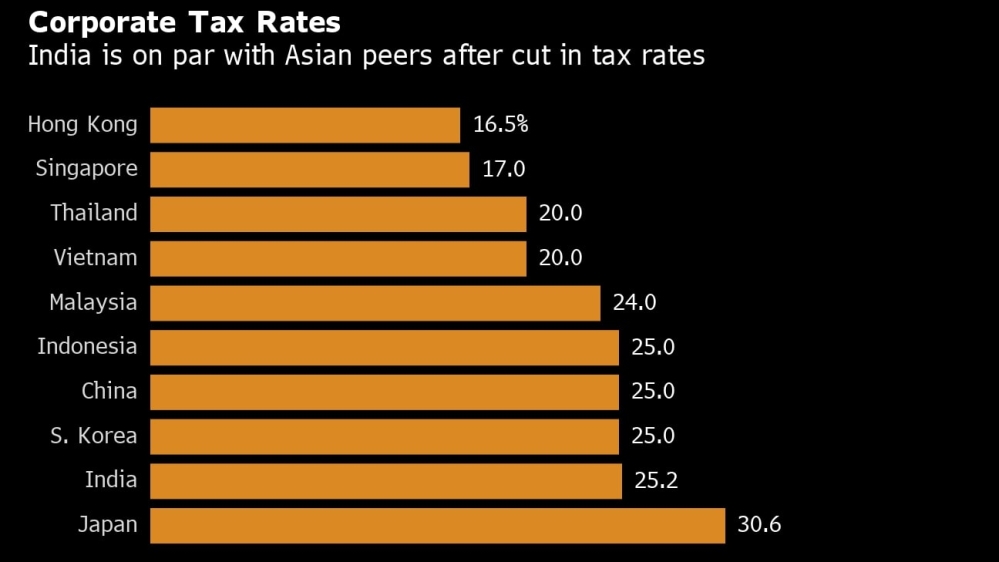

Indian Corporate Tax Rates Among The Lowest In Asia

Indian Corporate Tax Rates Among The Lowest In Asia

Singapore Tax Rates Contactone

Singapore Tax Rates Contactone

Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcsoavnosyqniisaezrfmfrj4hmunzliy9rbniw4xr80ahk8co7o Usqp Cau

Chart Of The Day Singapore S Business Tax One Of The Lowest In

Corporate Tax Rates Around The World 2018 Tax Foundation

Corporate Tax Rates Around The World 2018 Tax Foundation

Corporate Taxation In Singapore Offshore News Flash

Uk S Lower Corporate Tax Unlikely To Affect Singapore Companies

Uk S Lower Corporate Tax Unlikely To Affect Singapore Companies

Corporate Tax In Singapore Taxation Guide

Corporate Tax In Singapore Taxation Guide

Ray Of Light India S Government Delights Businesses By Slashing

Ray Of Light India S Government Delights Businesses By Slashing

High Corporate Income Tax Less Pay For Workers Gary D

Singapore Corporate Tax Guide Guides Singapore Incorporation

Singapore Corporate Tax Guide Guides Singapore Incorporation

Singapore Corporate Tax Rate Forecast

Singapore Corporate Tax Rate Forecast

Corporate Taxes Economic Financial Indicators The Economist

Is China Corporate Tax Rate High Or Low Michele Geraci

Is China Corporate Tax Rate High Or Low Michele Geraci

Corporate Tax Rates Around The World 2018 Tax Foundation

Corporate Tax Rates Around The World 2018 Tax Foundation

What Is The Income Tax Rate For Salaried Professionals In

What Is The Income Tax Rate For Salaried Professionals In

How Much Taxes To Pay In Singapore If You Re An Expat

How Much Taxes To Pay In Singapore If You Re An Expat

Corporation Tax Rates Effective And Nominal Download Table

Corporation Tax Rates Effective And Nominal Download Table

How Does India S Corporate Tax Rate Compare With Other Asian

How Does India S Corporate Tax Rate Compare With Other Asian

Corporate Tax Rates Around The World 2018 Tax Foundation

Corporate Tax Rates Around The World 2018 Tax Foundation

Don S Column Singapore Corporate Tax Rate

Don S Column Singapore Corporate Tax Rate

Singapore Corporate Tax Explained Considerations For Business

Singapore Corporate Tax Explained Considerations For Business

Us Corporate Tax Cuts Unnerve Asian Economies Nikkei Asian Review

Us Corporate Tax Cuts Unnerve Asian Economies Nikkei Asian Review

Singapore Tax Rates Paul Hype Page Co

Singapore Tax Rates Paul Hype Page Co

Corporate Tax In Singapore How To Pay Tax Rate Exemptions

Corporate Tax In Singapore How To Pay Tax Rate Exemptions

Personal Income Tax Rates For Singapore Tax Residents Ya 2010 2019

Personal Income Tax Rates For Singapore Tax Residents Ya 2010 2019

Posting Komentar

Posting Komentar