What Is The Irs Fresh Start Initiative

The irs fresh start initiative was designed to give taxpayers laden with first time tax debt a second chance to do things right and it included. It is for the irs.

Everything You Need To Know About The Irs Fresh Start Initiative 2019

Everything You Need To Know About The Irs Fresh Start Initiative 2019

The program is designed to help individuals and small businesses with overdue tax liabilities and it also has the benefit of helping the irs by removing taxpayers from its vast collection inventory.

What is the irs fresh start initiative. Now to help a greater number of taxpayers the irs has. The irs fresh start initiative was created to expand the benefits and assistance originally offered by the irs restructuring and reform act of 1998 making it ever easier for taxpayers to deal with excessive back taxes and get out of irs debt. The irs fresh start initiative expanded several programs to help taxpayers struggling with unpaid tax debt.

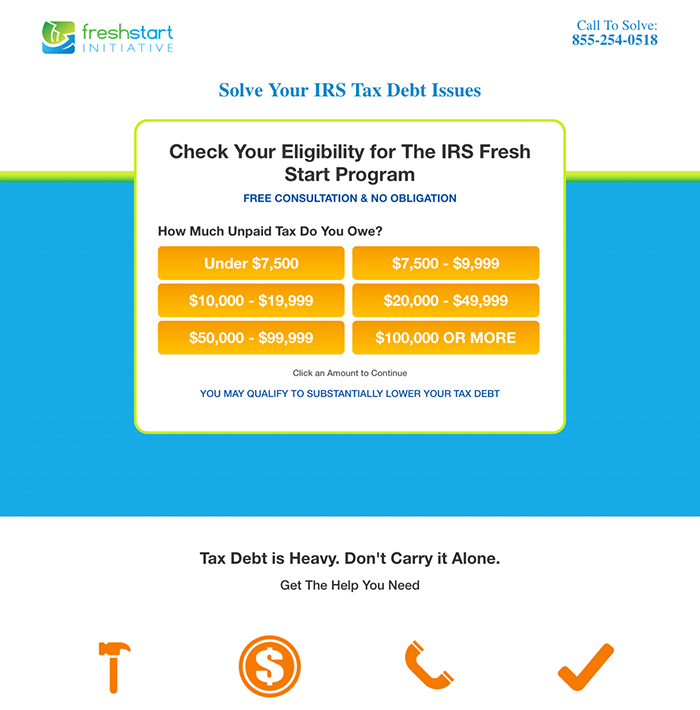

If so the irs fresh start program for individual taxpayers and small businesses can help. The irs fresh start program can help deserving taxpayers get back on their feet financially. The irs fresh start program can help you pay your taxes.

The irs fresh start program isn t just for your benefit. These changes quickly resulted in fewer ftls. The application fee for offer in compromise is 205 unless you qualify for the low income certification or submit a doubt as to liability offer.

Notification effective april 27 2020. The internal revenue service irs expands the fresh start program for taxpayers. Are you struggling to pay your federal taxes.

On may 21 2012 the irs announced the expansion of the fresh start initiative by offering more flexible terms in its offer in compromise oic program. Finding an option to settle your tax debt is a lot easier now as the tax relief options available add more potential ways to mitigate tax debts if the irs fresh start program will not work for you. The irs began fresh start in 2011 to help struggling taxpayers.

The irs s people first initiative offers relief for taxpayers with offers in compromise. The goal of the program was to help taxpayers and small businesses with paying back taxes and avoiding tax liens. Raising the dollar amount that triggered federal tax liens ftls being filed from 5 000 to 10 000 initially and then to 25 000 a few months later.

The irs fresh start s a bit of a win win the initiative makes it easier for individual and small business taxpayers. The fresh start program increased the threshold to qualify for a streamlined installment agreement from 25 000 to 50 000 if the balance can be paid in full within six years previously five years. Once delinquent returns have been filed taxpayers with a tax liability should consider taking the opportunity to resolve any outstanding liabilities by entering into an installment agreement or an offer in compromise with the irs to obtain a fresh start see irs gov for further information.

The irs officially launched the fresh start program back in 2011 with the aim of helping taxpayers get a fresh start with their tax debt and get some relief.

Everything You Need To Know About The Irs Fresh Start Initiative 2019

Everything You Need To Know About The Irs Fresh Start Initiative 2019

Irs Fresh Start Program Makes It Easier To Settle Back Taxes

Irs Fresh Start Program Makes It Easier To Settle Back Taxes

What Is The Irs Fresh Start Program Apply Now Thecreditreview

What Is The Irs Fresh Start Program Apply Now Thecreditreview

Still Have Tax Debt The Irs Fresh Start Initiative May Help The

How To Settle Tax Debt With The Irs Fresh Start Program Credit

How To Settle Tax Debt With The Irs Fresh Start Program Credit

What Is The Irs Fresh Start Tax Relief Program

What Is The Irs Fresh Start Tax Relief Program

Irs Fresh Start Initiative Gq Law

Fortress Financial Services Inc Shares The Truth About The Irs

Fortress Financial Services Inc Shares The Truth About The Irs

Irs Fresh Start Program A Guide To The Fresh Start Initiative

Irs Fresh Start Program A Guide To The Fresh Start Initiative

Irs Fresh Start Initiative Overview Changes To Tax Programs

Irs Fresh Start Initiative Overview Changes To Tax Programs

Latest Irs Fresh Start Initiative Qualifications Fresh Start

Latest Irs Fresh Start Initiative Qualifications Fresh Start

2020 Guide To The Irs Fresh Start Initiative Best Tax

2020 Guide To The Irs Fresh Start Initiative Best Tax

Tax Relief Program Irs Fresh Start Initiative Youtube

Tax Relief Program Irs Fresh Start Initiative Youtube

Irs Fresh Start Initiative Alg Tax Solutions

The Irs Fresh Start Initiative How To Start Fresh Wiztax

The Irs Fresh Start Initiative How To Start Fresh Wiztax

Irs Fresh Start Initiative What Is It And How Can It Help Me

Irs Fresh Start Initiative What Is It And How Can It Help Me

What Is The Irs Debt Forgiveness Program Tax Defense Network

What Is The Irs Debt Forgiveness Program Tax Defense Network

Irs Fresh Start Initiative Which Taxpayers Does It Help

Irs Fresh Start Initiative Which Taxpayers Does It Help

![]() What S The Irs Fresh Start Program The New Initiative Guide Video

What S The Irs Fresh Start Program The New Initiative Guide Video

Irs Fresh Start Initiative Helps Taxpayers Tax Problems

The Irs Fresh Start Initiative 4 Key Takeaways Requirements

The Irs Fresh Start Initiative 4 Key Takeaways Requirements

2019 Fresh Start Initiative Program Of Irs

2019 Fresh Start Initiative Program Of Irs

Latest Irs Fresh Start Initiative Qualifications Fresh Start

Latest Irs Fresh Start Initiative Qualifications Fresh Start

How To Settle Tax Debt With The Irs Fresh Start Program Credit

How To Settle Tax Debt With The Irs Fresh Start Program Credit

Irs And The Fresh Start Initiative

Irs And The Fresh Start Initiative

Irs Hotline Tv Commercial Fresh Start Initiative Ispot Tv

Irs Hotline Tv Commercial Fresh Start Initiative Ispot Tv

Irs Fresh Start Initiative Program Help Dallas Fort Worth Tx

Irs Fresh Start Initiative Program Help Dallas Fort Worth Tx

Irs Fresh Start Initiative Life Back Tax

How The Irs Fresh Start Initiative Reduces Business Tax Liabilities

How The Irs Fresh Start Initiative Reduces Business Tax Liabilities

Fresh Start Initiative Review Updated Feb 2019 Thecreditreview

Fresh Start Initiative Review Updated Feb 2019 Thecreditreview

What Is The Irs Fresh Start Tax Relief Program

What Is The Irs Fresh Start Tax Relief Program

Irs Fresh Start Initiative Archives Tax Attorney And Irs Defense

The Irs Fresh Start Initiative 4 Key Takeaways Requirements

The Irs Fresh Start Initiative 4 Key Takeaways Requirements

The Irs Fresh Start Initiative 4 Key Takeaways Requirements

The Irs Fresh Start Initiative 4 Key Takeaways Requirements

![]() What S The Irs Fresh Start Program The New Initiative Guide Video

What S The Irs Fresh Start Program The New Initiative Guide Video

Irs Fresh Start Program How It Can Help W Your Tax Problems

Irs Fresh Start Program How It Can Help W Your Tax Problems

Posting Komentar

Posting Komentar