1042 S Form

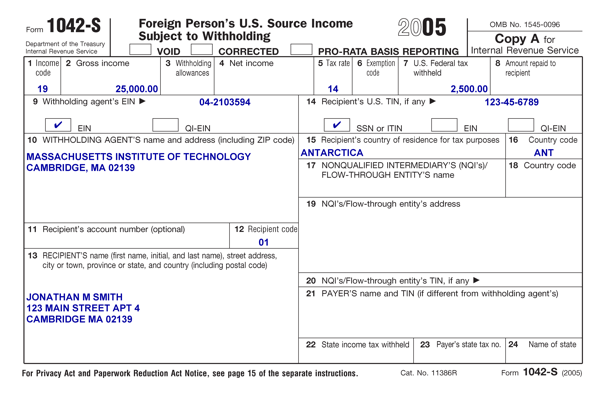

Form 1042 s is used by a withholding agent for an information return to report certain income paid to addresses in foreign countries. This can include investments or capital distribution.

Source income subject to withholding go to www irs gov form1042s for instructions and the latest information.

1042 s form. Use form 1042 to report the following. References and discussion of forms 1042 1042 s and form 1042 t. Instead form w 2 should be used.

Use form 1042 s to report specified federal procurement payments paid to foreign persons that are subject to withholding under section 5000c. Source income of foreign persons is used to report tax withheld on the income of foreign persons. Use form 1042 to report tax withheld on certain income of foreign persons.

Form 1042 s is used to report amounts paid to foreign persons including persons presumed to be foreign who are subject to income tax withholding. For internal revenue service. Forms 1042 1042 s and 1042 t are united states internal revenue service tax forms dealing with payments to foreign persons including non resident aliens foreign partnerships foreign corporations foreign estates and foreign trusts.

Forms have been completely redesigned to reflect changes made to the regulations under internal revenue code chapters 3 and 4 fatca. The form is sent to the non resident by the bank or corporation that handles the transaction. Under the tax laws of the united states form 1042 s is not used to report wages for income tax purposes.

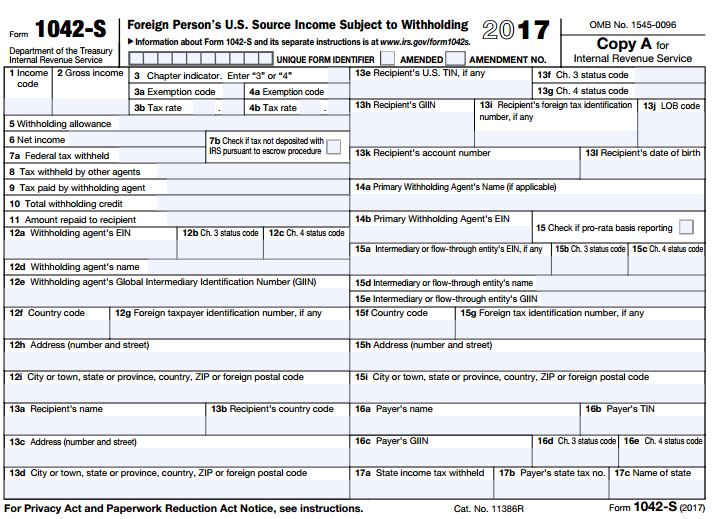

Unique form identifier amended. Form 1042 s department of the treasury internal revenue service foreign person s u s. Income and amounts withheld as described in the instructions for form 1042 s.

For an individual taxpayer form 1042 s is a document provided to you and the irs by the payer of the income reported. Therefore form 1042 is concerned with how much income will be withheld for tax purposes and form 1042 s is only concerned with payments made to foreign persons. Information about form 1042 annual withholding tax return for u s.

Use form 1042 s to report income described under amounts subject to reporting on form 1042 s later and to report amounts withheld under chapter 3 or chapter 4. Form 1042 annual withholding tax return for u s. Source income of foreign persons including recent updates related forms and instructions on how to file.

Use form 1042 annual withholding tax return for u s. However if earnings are exempt from income tax withholding because of a tax treaty between the earner s home country and the united states then form 1042 s can be used. Source income of foreign persons to report.

Use form 1042 s to report. Irs form 1042 s is a tax form for foreign individuals reporting income from a united states based source in other words non residents who conduct some form of business within the united states.

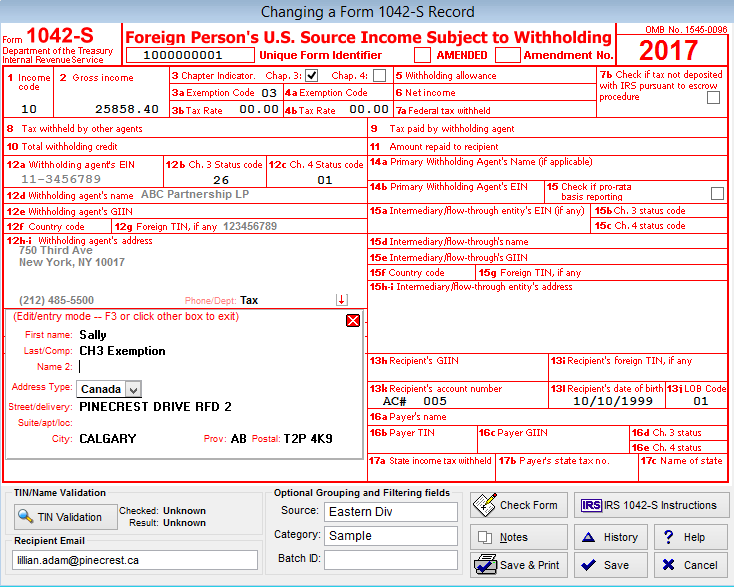

1042 S 2017 Public Documents 1099 Pro Wiki

1042 S 2017 Public Documents 1099 Pro Wiki

Understanding Your 1042 S Payroll Boston University

Understanding Your 1042 S Payroll Boston University

1042 S Tax Form Copy C Laser W 2taxforms Com

1042 S Tax Form Copy C Laser W 2taxforms Com

Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcsagobaetkw7ctx5temroio1goicaq8 Tlgcj6w7mh Tlxbrvcd Usqp Cau

Www Invesco Com Static Sf Us Assets Img Tax Gui

Www Invesco Com Static Sf Us Assets Img Tax Gui

Understanding Your Form W 2 And 1042 S Information Regarding Your

Understanding Your Form W 2 And 1042 S Information Regarding Your

3 21 110 Processing Form 1042 Withholding Returns Internal

3 21 110 Processing Form 1042 Withholding Returns Internal

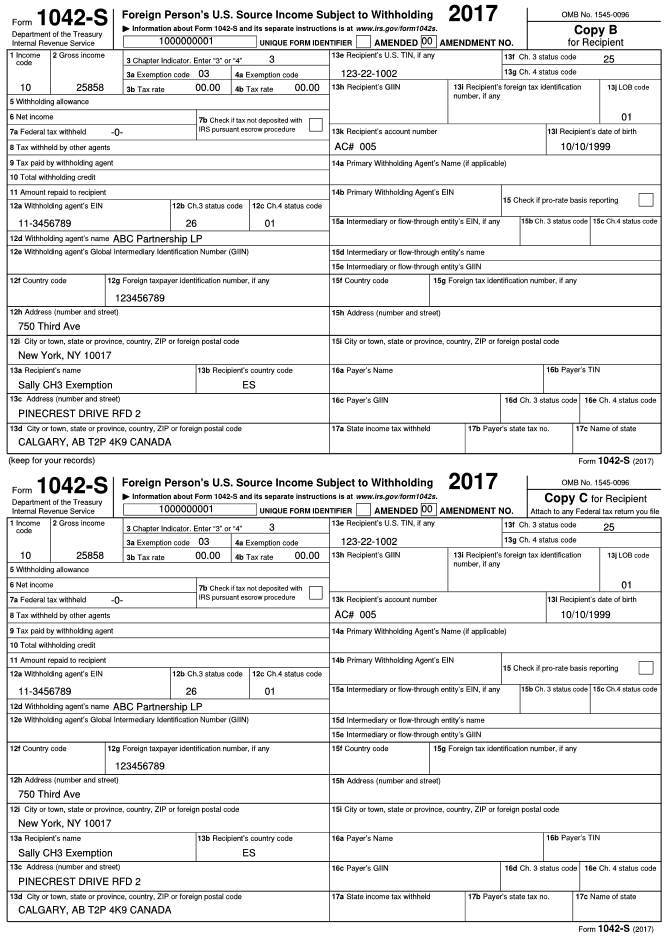

1042 S 2up Recipient Copy B 1042sb05 Greatland

1042 S 2up Recipient Copy B 1042sb05 Greatland

Irs Form 1042 S Download Fillable Pdf Or Fill Online Foreign

Irs Form 1042 S Download Fillable Pdf Or Fill Online Foreign

1042 S Software 1042 S Efile Software 1042 S Reporting

1042 S Software 1042 S Efile Software 1042 S Reporting

Sample Form 1042 S John Hancock Investment Mgmt

Sample Form 1042 S John Hancock Investment Mgmt

3 21 110 Processing Form 1042 Withholding Returns Internal

3 21 110 Processing Form 1042 Withholding Returns Internal

1042 S Tax Form Copy A Laser W 2taxforms Com

1042 S Tax Form Copy A Laser W 2taxforms Com

Form 1042 S Foreign Person S U S Source Income Subject To Withholding

Form 1042 S Foreign Person S U S Source Income Subject To Withholding

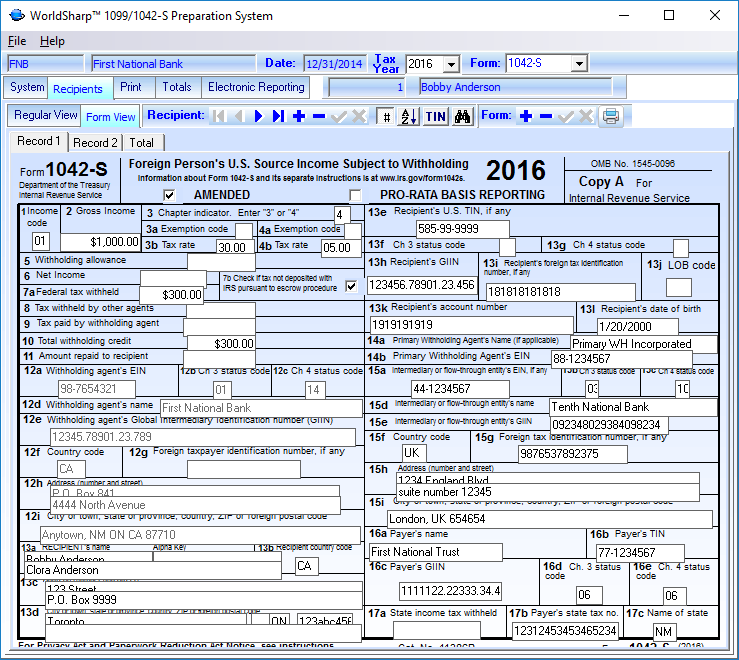

1042 S Software Worldsharp 1099 1042 S Software Features

1042 S Software Worldsharp 1099 1042 S Software Features

Turbotax 1042s Treaty Fill Online Printable Fillable Blank

Turbotax 1042s Treaty Fill Online Printable Fillable Blank

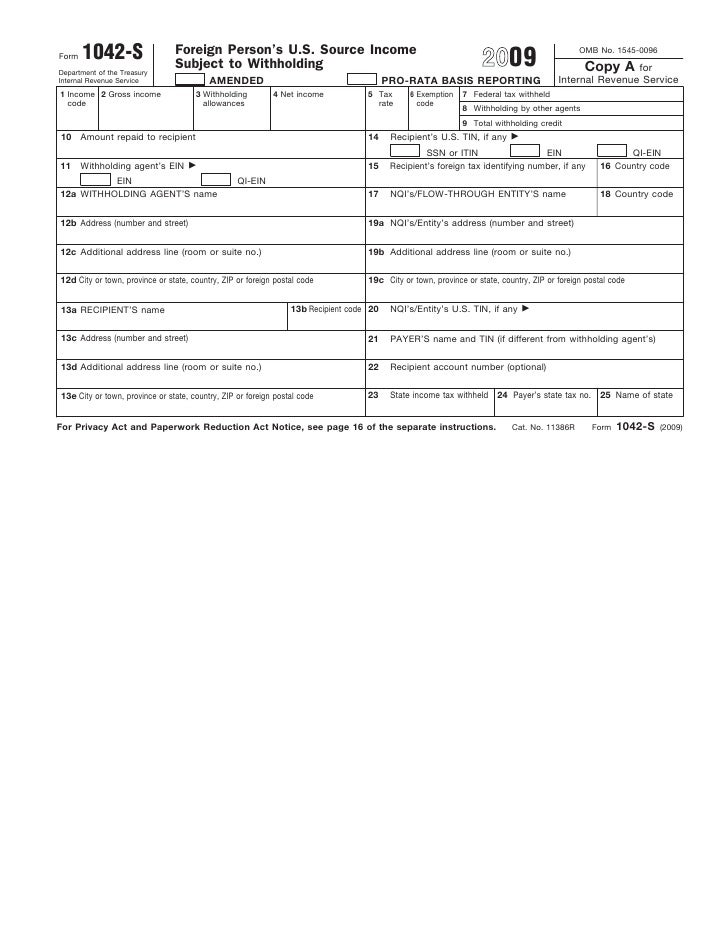

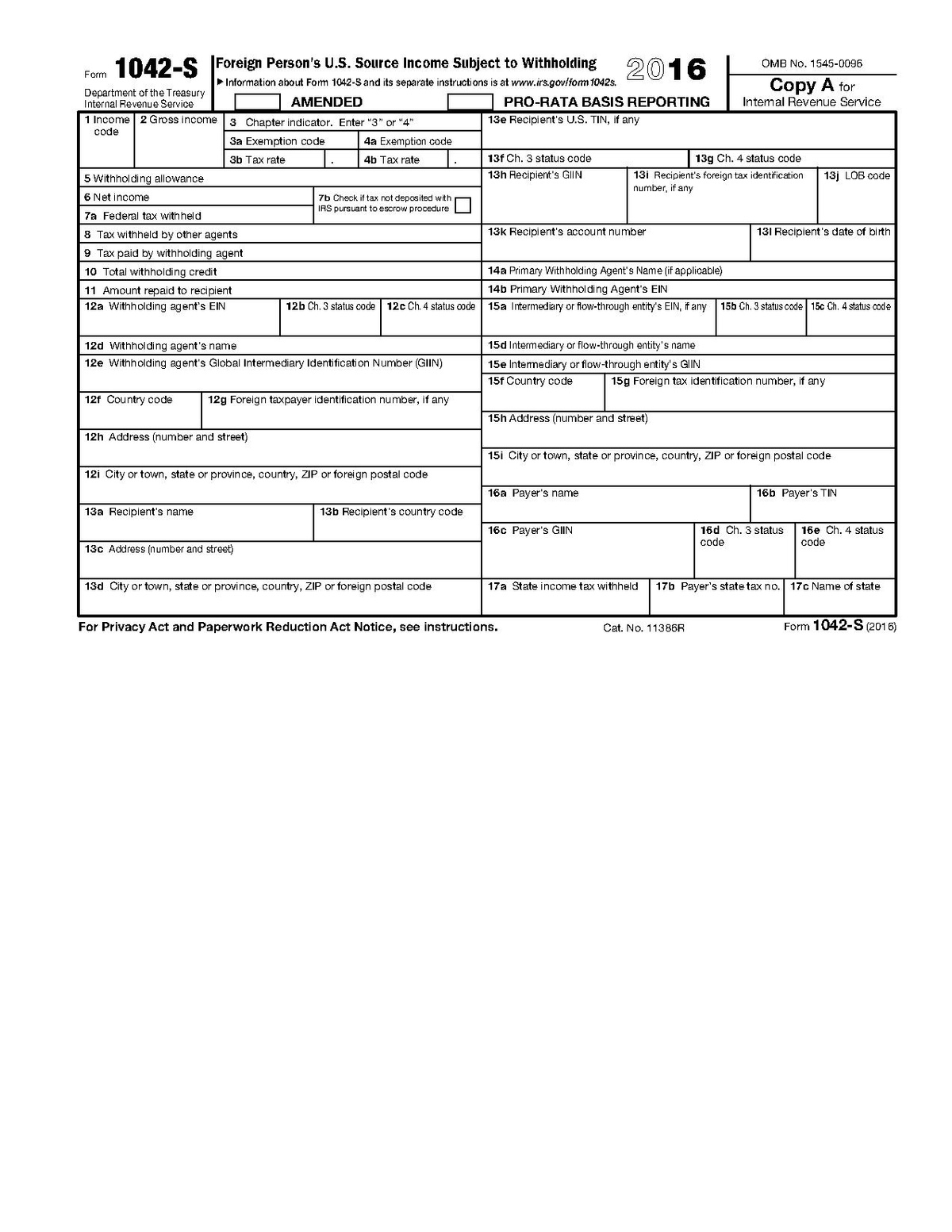

1042 S 2016 Public Documents 1099 Pro Wiki

Irs Form 1042 S Software Efile For 499 Outsource 799

Irs Form 1042 S Software Efile For 499 Outsource 799

Irs Form 1042 S Software Efile For 499 Outsource 599 1042 S

Irs Form 1042 S Software Efile For 499 Outsource 599 1042 S

1042 S Form Copy A Federal 1042sfed05

1042 S Form Copy A Federal 1042sfed05

The 1042 S Form Explained Us Tax Recovery Service 1042 S Tax

The 1042 S Form Explained Us Tax Recovery Service 1042 S Tax

Https Uwservice Wisconsin Edu Docs Publications Itx 1042s Explanation Pdf

Irs Approved 1042 S Recipient S Federal Copy C Tax Form 100

Irs Approved 1042 S Recipient S Federal Copy C Tax Form 100

3 21 111 Chapter Three And Chapter Four Withholding Returns

3 21 111 Chapter Three And Chapter Four Withholding Returns

Laser 1042 S Recipient Copy C Tf5322 At Print Ez

Laser 1042 S Recipient Copy C Tf5322 At Print Ez

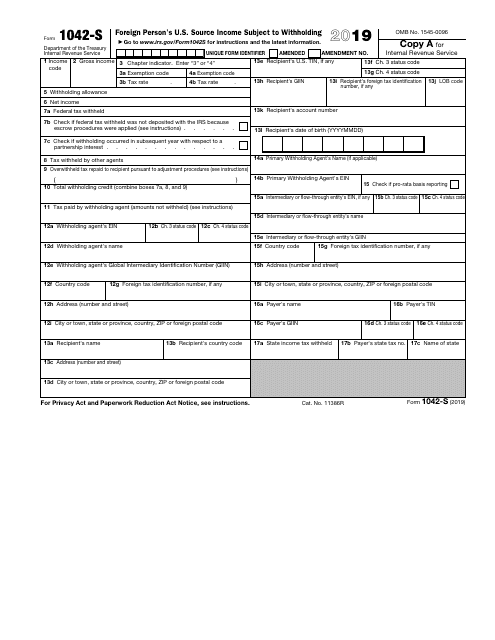

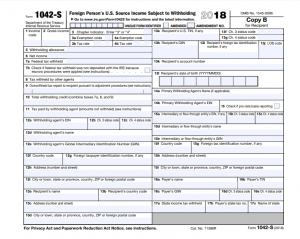

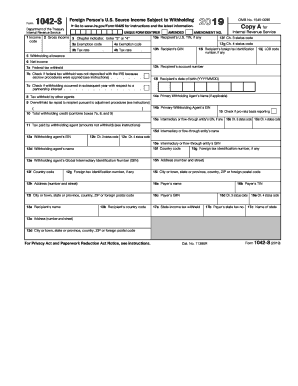

1042 S 2018 Public Documents 1099 Pro Wiki

Form 1042 S Explained Foreign Person S U S Source Income Subject

Form 1042 S Explained Foreign Person S U S Source Income Subject

1042 S Software 1042 S Efile Software 1042 S Reporting

1042 S Software 1042 S Efile Software 1042 S Reporting

Posting Komentar

Posting Komentar