Average Cost Inventory Method

Doing so avoids the larger amount of work required to track the cost of each individual security. The weighted average cost wac method of inventory valuation uses a weighted average to determine the amount that goes into cogs and inventory.

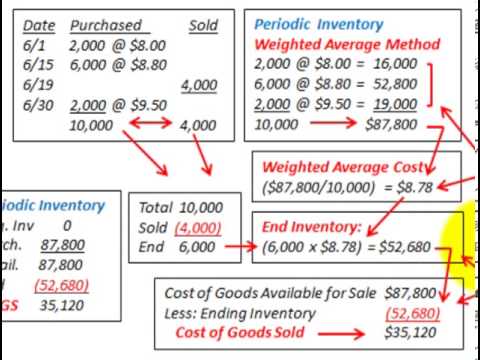

Inventory Costing Weighted Average Periodic Youtube

Inventory Costing Weighted Average Periodic Youtube

To determine the value of the remaining inventory using the average cost method of inventory the 5 25 average calculated above would be multiplied by 800 the number of remaining cell phone covers.

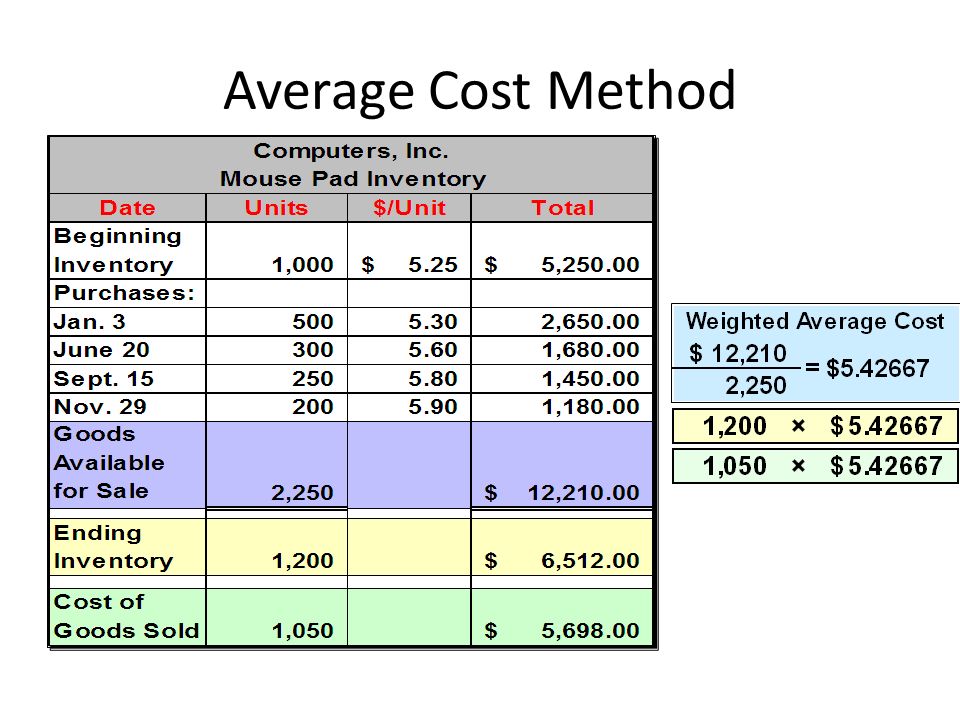

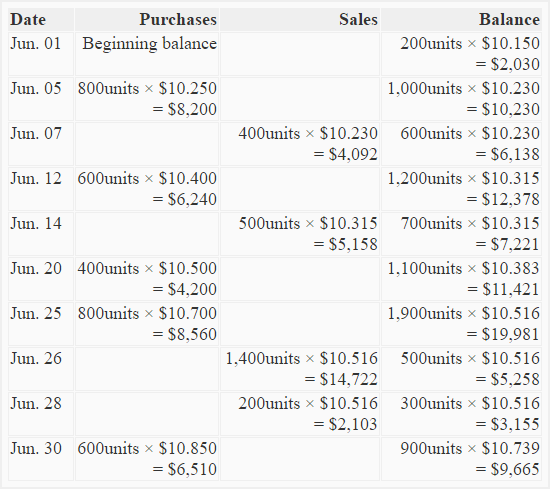

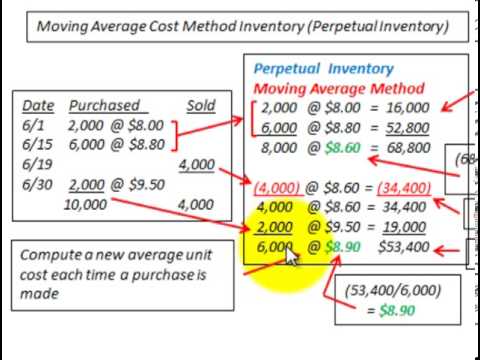

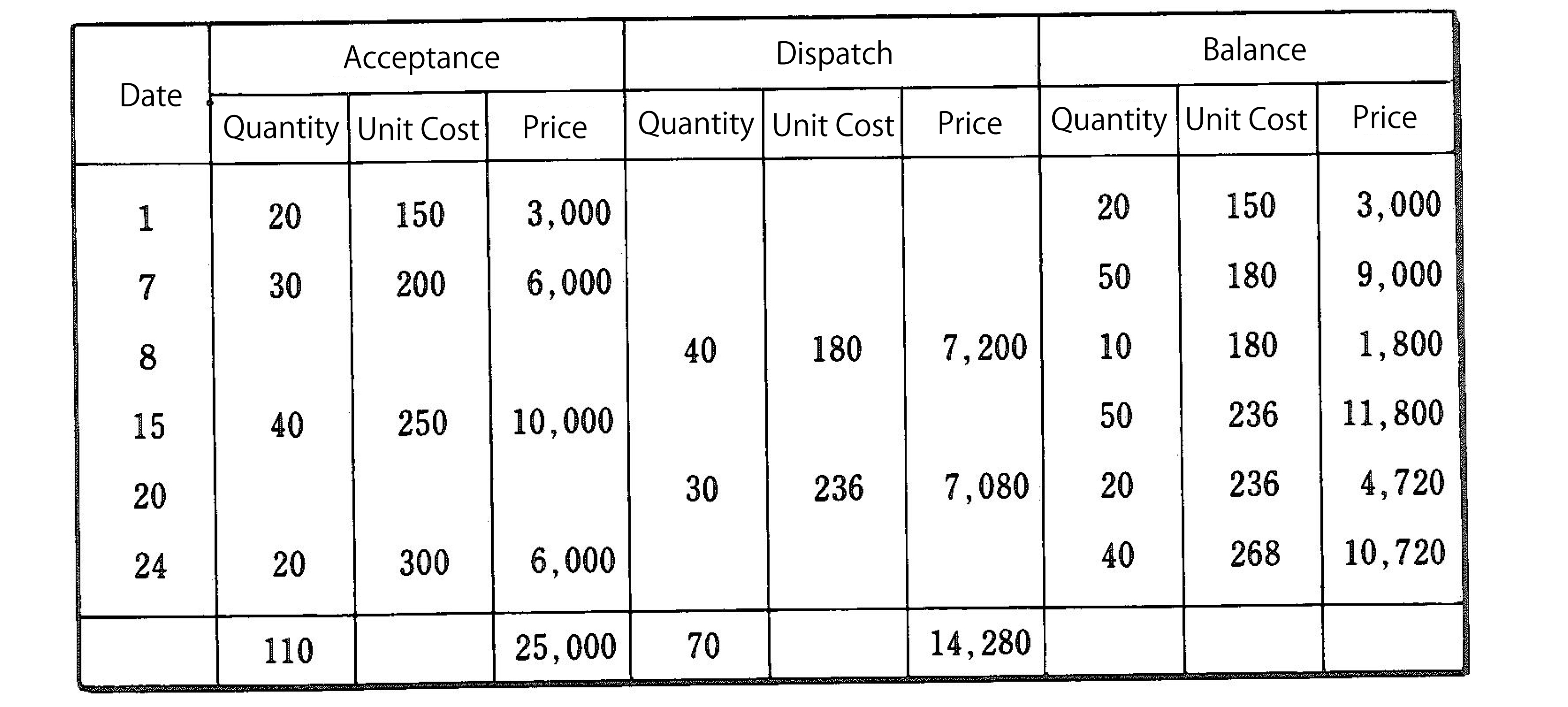

Average cost inventory method. This method can also be used to determine the average amount invested in each of a group of securities. Under the moving average inventory method the average cost of each inventory item in stock is re calculated after every inventory purchase. The formula of weighted average unit cost can be expressed as follows.

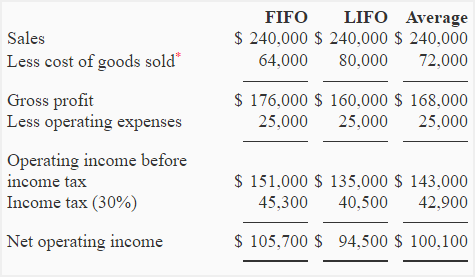

Advantages disadvantages of average cost method. The wac method is permitted under both gaap and ifrs. Simple weighted average cost method and perpetual weighted average cost method.

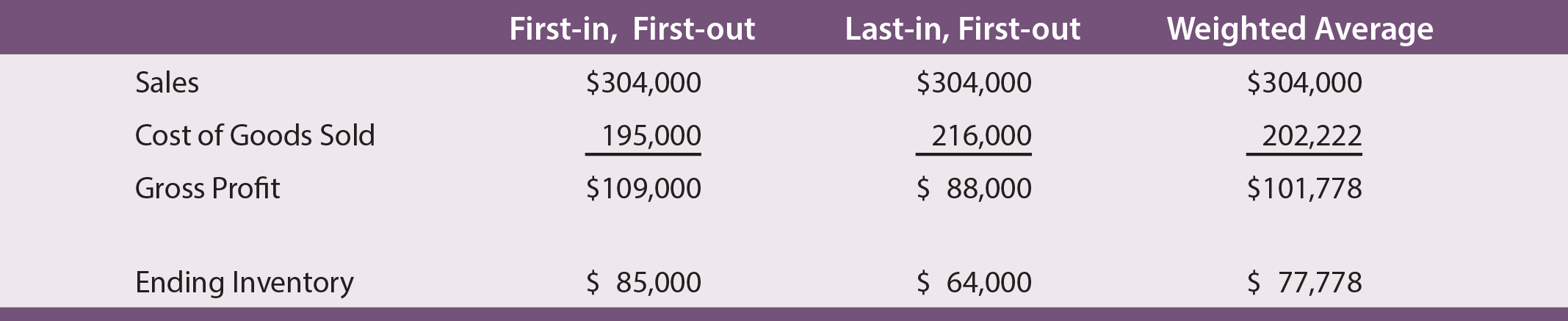

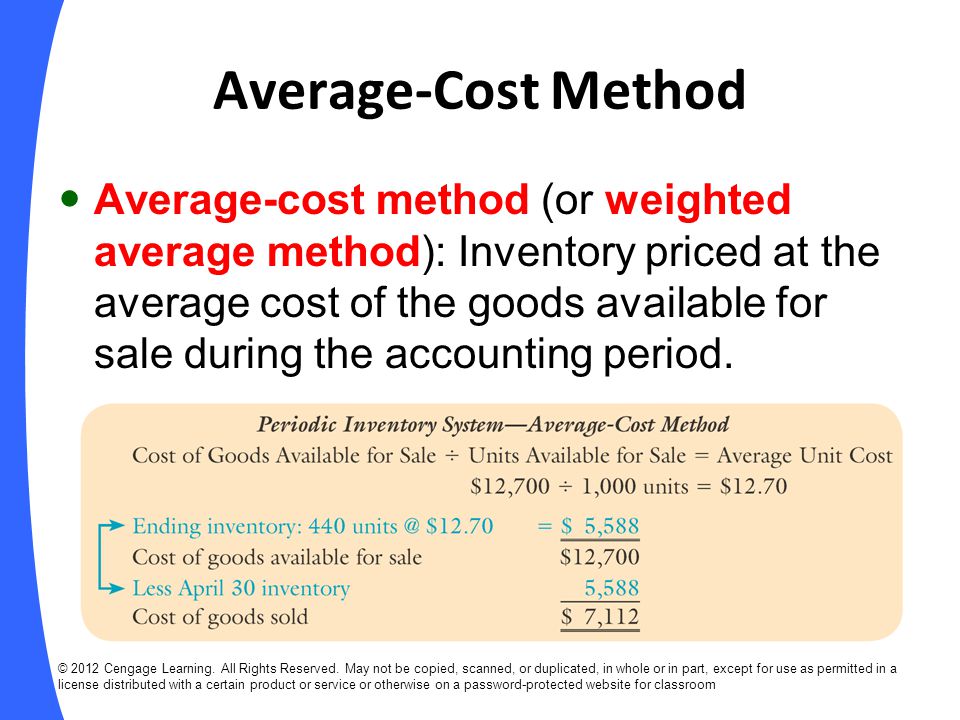

The average cost method is a cost flow assumption that applies the. This method tends to yield inventory valuations and cost of goods sold results that are in between those derived under the first in first out fifo method and the last in first out lifo method. The weighted average cost method divides the cost of goods available for sale by the number of units available for sale.

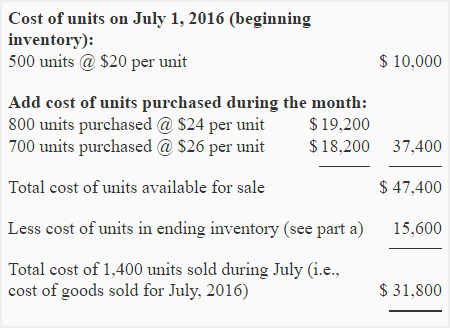

There is 4 200 worth of inventory left based on this calculation. Inventory costing places a dollar value on items held for production or sale. Under average costing method the average cost of all similar items in the inventory is computed and used to assign cost to each unit sold like fifo and lifo methods this method can also be used in both perpetual inventory system and periodic inventory system.

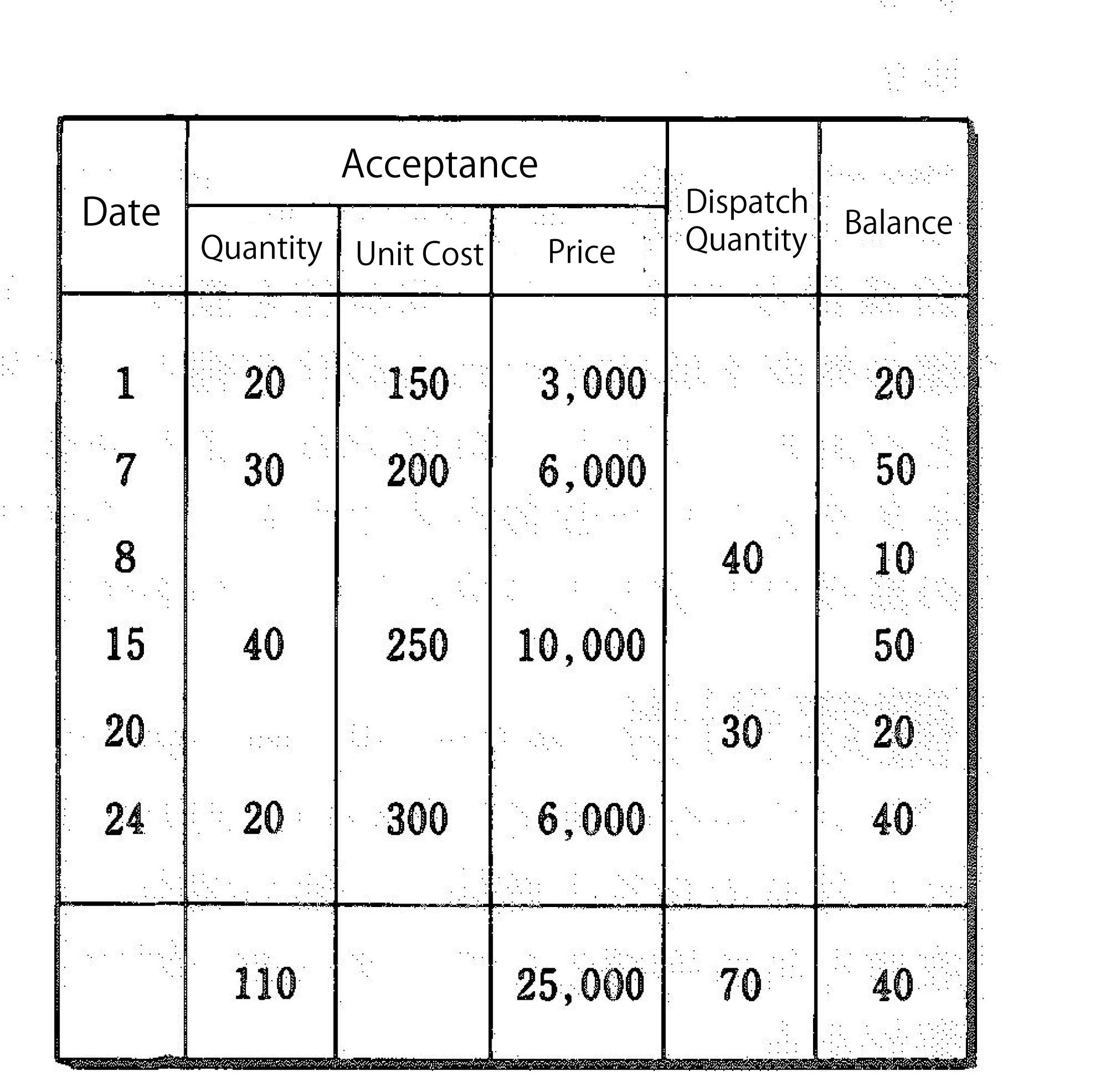

Example apply avco method of inventory valuation on the following information first in periodic inventory system and then in perpetual inventory system to determine the value of inventory on hand on mar 31 and cost of goods sold. The average cost method is an inventory costing method in which the cost of each item in an inventory is calculated on the basis of the average cost of all similar goods in. The result is 800 x 5 25 4 200.

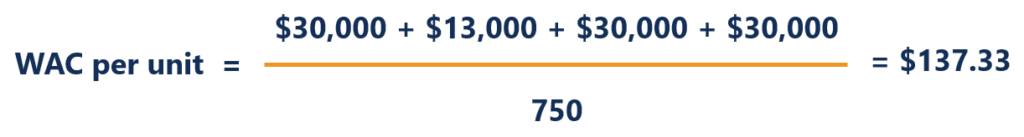

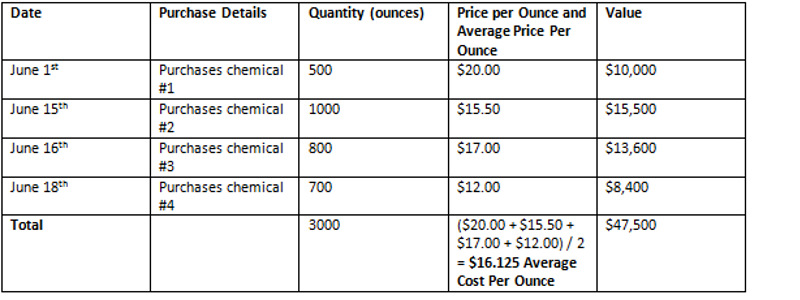

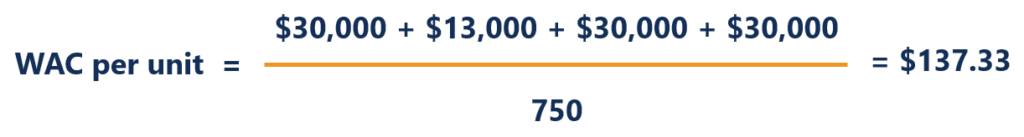

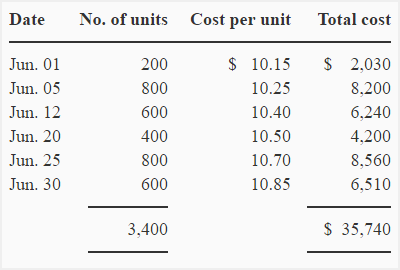

The average cost is computed by dividing the total cost of goods available for sale by the total units available for sale. The calculation of inventory value under average cost method is explained with the help of the following example. The idea behind it is to assign a weighted average unit cost to the cost of a product.

The average costing calculation is. Cost of goods available for sale total units from beginning inventory and purchases average cost. This gives a weighted average unit cost that is applied to the units in the ending inventory.

Accuracy is critical because the value placed on items affects working capital requirements and the cost of goods sold. When average costing method is used in a periodic inventory system the cost of. Moving average inventory method overview.

There are two commonly used average cost methods. The average cost inventory method is an accounting technique used to calculate the cost of goods sold and ending inventory. Average costing method in periodic inventory system.

Exercise 3 Fifo Lifo And Average Cost Method In Periodic

Exercise 3 Fifo Lifo And Average Cost Method In Periodic

Weighted Average Cost Accounting Inventory Valuation Method

Weighted Average Cost Accounting Inventory Valuation Method

Inventory And Cost Of Goods Sold Weighted Average Youtube

Inventory And Cost Of Goods Sold Weighted Average Youtube

Fifo And Lifo Accounting And The Weighted Average Method

Valuing Inventory Boundless Accounting

Valuing Inventory Boundless Accounting

E7 6 Algo Calculating Ending Inventory And Cost Of Goods Sold

E7 6 Algo Calculating Ending Inventory And Cost Of Goods Sold

Solved Assuming Neer Maintains Perpetual Inventory Recor

Solved Assuming Neer Maintains Perpetual Inventory Recor

Weighted Average Inventory Moving Average Inventory Perpetual Vs

Weighted Average Inventory Moving Average Inventory Perpetual Vs

Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcsck6tuk3udrykpdpc7yow5llsdrym39lzicr7528hr9ydctc0 Usqp Cau

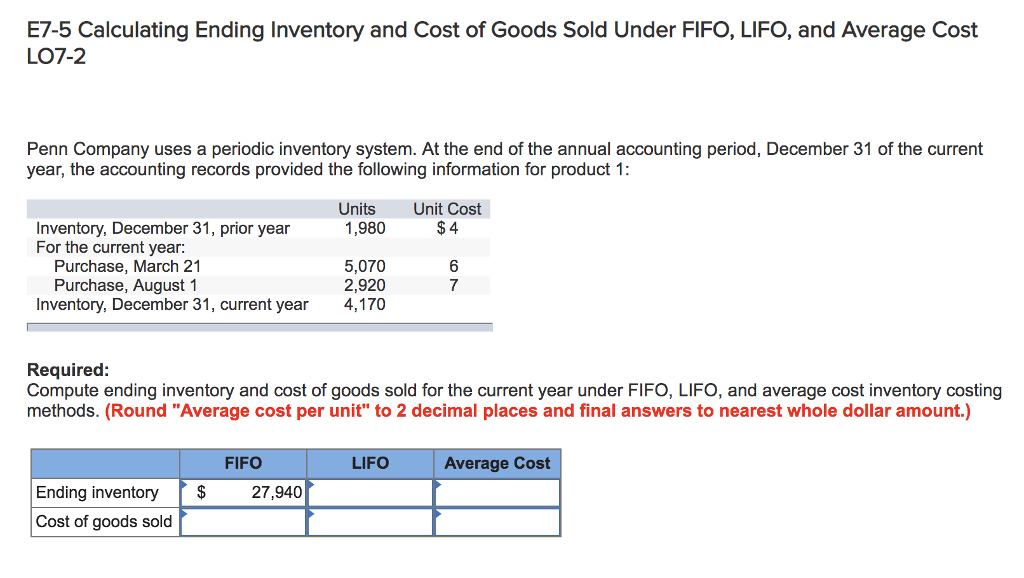

Solved E7 5 Calculating Ending Inventory And Cost Of Good

Solved E7 5 Calculating Ending Inventory And Cost Of Good

Average Cost Inventory Method Avco Definition Formula

Inventory Costing Methods Principlesofaccounting Com

Inventory Costing Methods Principlesofaccounting Com

Reporting And Interpreting Cost Of Goods Sold And Inventory Ppt

Reporting And Interpreting Cost Of Goods Sold And Inventory Ppt

Average Cost Method Of Inventory Examples Brandongaille Com

Average Cost Method Of Inventory Examples Brandongaille Com

Solved Problem 9 4 Retail Inventory Method Various Cost

Solved Problem 9 4 Retail Inventory Method Various Cost

Ending Inventory Formula Step By Step Calculation Examples

Ending Inventory Formula Step By Step Calculation Examples

Weighted Average Cost Accounting Inventory Valuation Method

Weighted Average Cost Accounting Inventory Valuation Method

Weighted Average Cost Avco Method Definition And Explanation

Answered Exercise 6 4 Riverbed Boards Sells A Bartleby

Answered Exercise 6 4 Riverbed Boards Sells A Bartleby

Inventory Valuation Methods Comparing Lifo Fifo And Wac Quickbooks

Inventory Valuation Methods Comparing Lifo Fifo And Wac Quickbooks

Financial Accounting 11e Ppt Download

Financial Accounting 11e Ppt Download

Average Cost Inventory Method Inventories Additional Ppt Download

Average Cost Inventory Method Inventories Additional Ppt Download

Inventory Valuation Cost Of Goods Sold Average Cost Method Png

Inventory Valuation Cost Of Goods Sold Average Cost Method Png

Weighted Average Inventory Method Calculations Periodic

Weighted Average Inventory Method Calculations Periodic

Average Costing Method Explanation And Examples Accounting For

Average Costing Method Explanation And Examples Accounting For

Weighted Average Inventory Method Calculations Periodic

Weighted Average Inventory Method Calculations Periodic

Weighted Average Method Inventory Control Mrp Glossary Of

Weighted Average Method Inventory Control Mrp Glossary Of

Moving Average Inventory Costing Perpetual Inventory Cogs

Moving Average Inventory Costing Perpetual Inventory Cogs

Perpetual Fifo Lifo Average And Comparisons Accountingcoach

Perpetual Fifo Lifo Average And Comparisons Accountingcoach

Average Cost Method Avco Double Entry Bookkeeping

Average Cost Method Avco Double Entry Bookkeeping

Moving Average Inventory Control Mrp Glossary Of Production

Moving Average Inventory Control Mrp Glossary Of Production

Inventory Methods For Ending Inventory Cost Of Goods Sold

Inventory Methods For Ending Inventory Cost Of Goods Sold

Average Costing Method Explanation And Examples Accounting For

Average Costing Method Explanation And Examples Accounting For

Exercise 11 Comparison Of Fifo Lifo And Average Costing Method

Exercise 11 Comparison Of Fifo Lifo And Average Costing Method

Weighted Average Inventory Method Calculations Periodic

Weighted Average Inventory Method Calculations Periodic

Inventory Costing Methods Principlesofaccounting Com

Inventory Costing Methods Principlesofaccounting Com

What Is The Weighted Average Cost Method Explained

What Is The Weighted Average Cost Method Explained

Posting Komentar

Posting Komentar