Manufacturing Overhead Costs Include

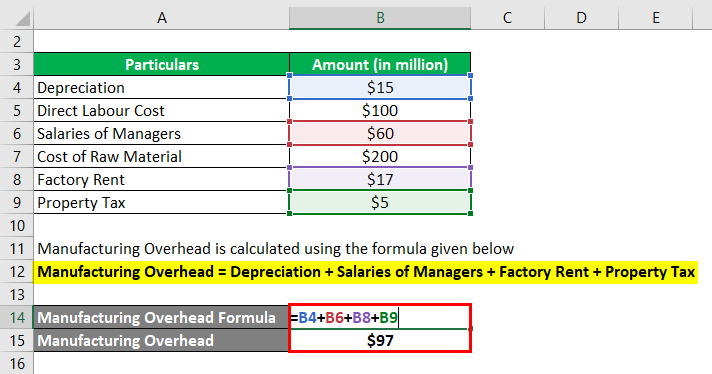

Cost of goods manufactured includes. Depreciation on equipment used in the production process.

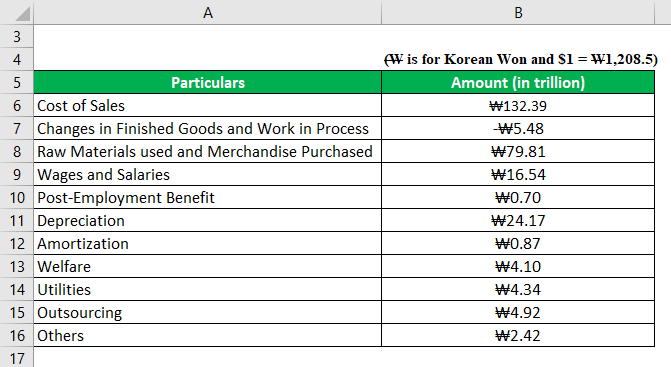

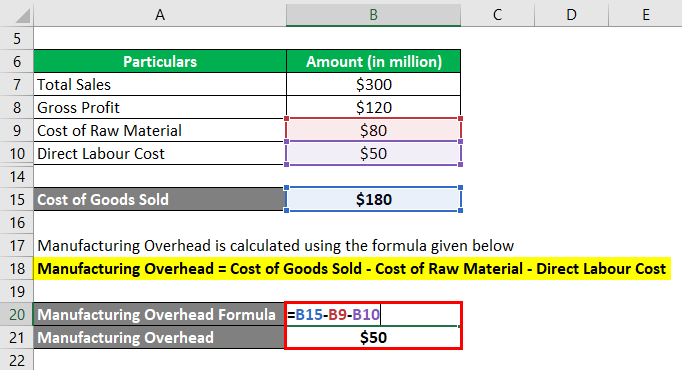

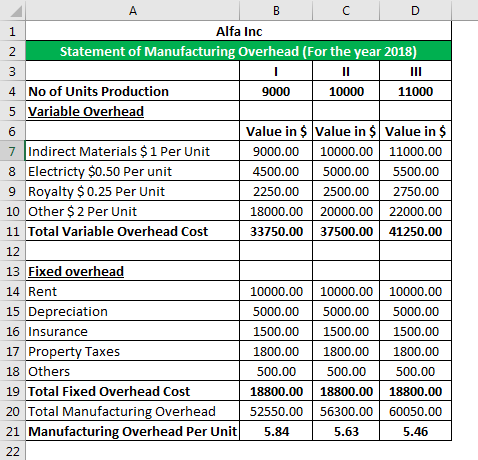

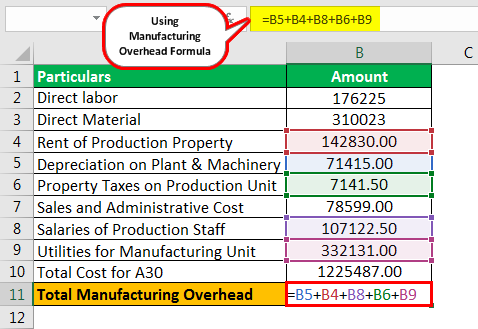

Manufacturing Overhead Formula Calculator With Excel Template

Manufacturing Overhead Formula Calculator With Excel Template

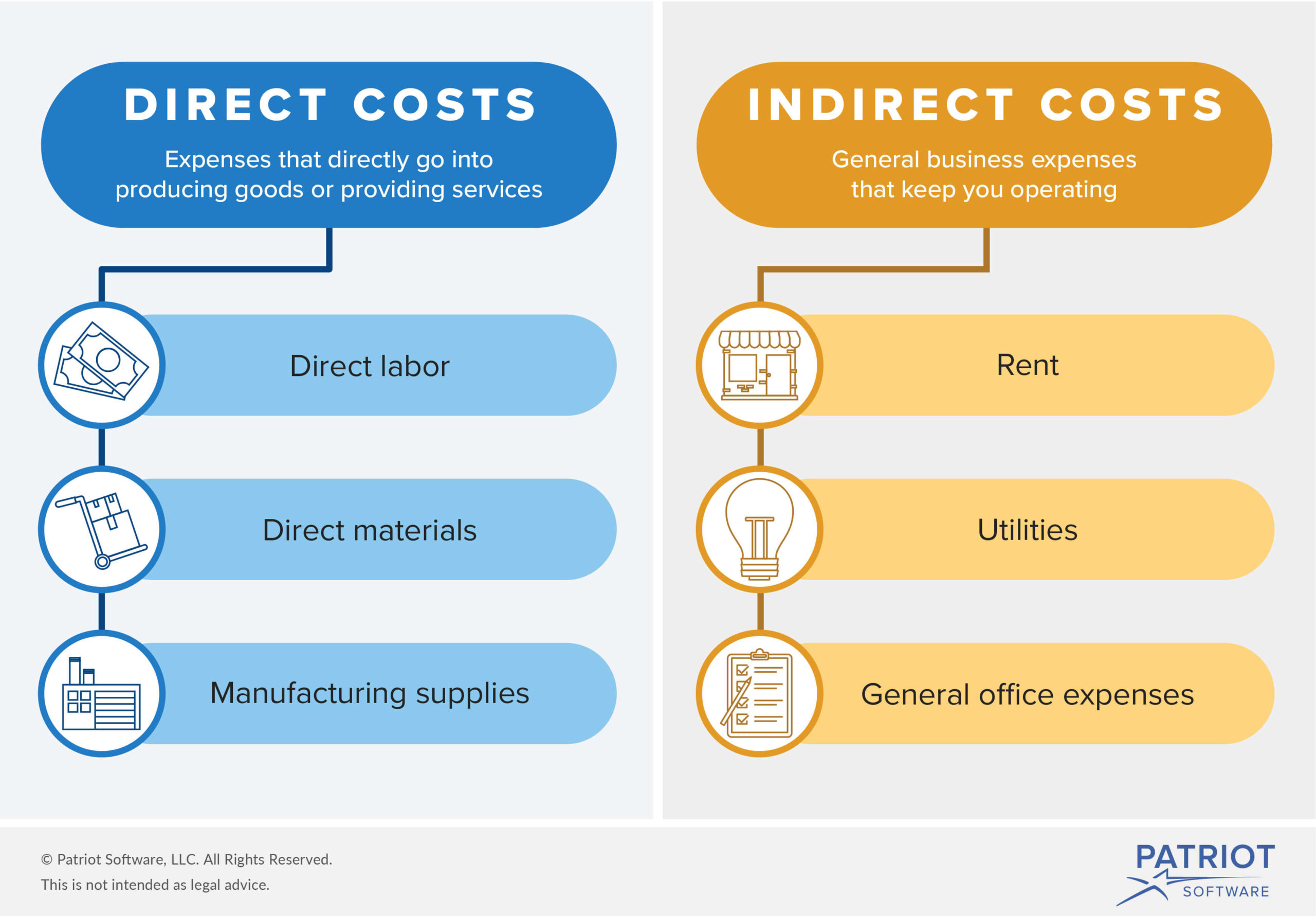

Basic types of business manufacturing costs businesses that manufacture products have several additional cost factors to consider compared with retailers and distributors.

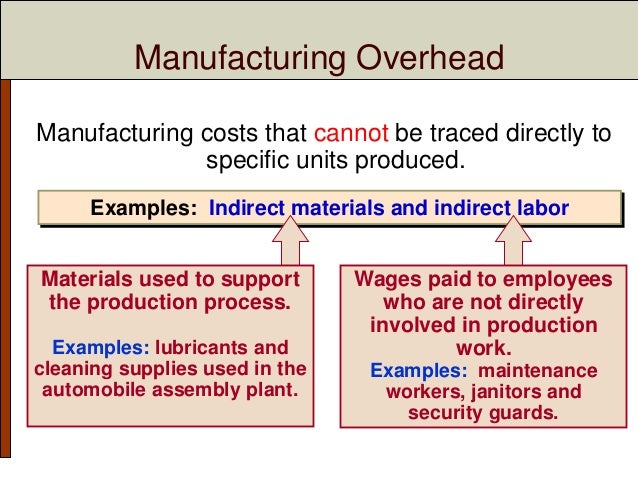

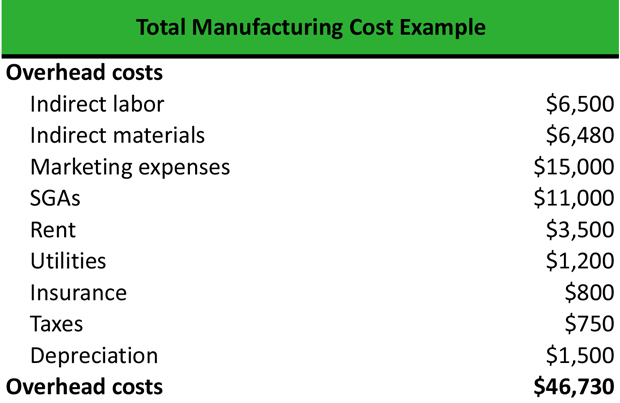

Manufacturing overhead costs include. A direct materials and direct labor only b direct material and manufacturing overhead only c direct labor and manufacturing overhead only d direct materials direct labor and manufacturing overhead. Manufacturing overhead costs include. Manufacturing overhead includes such things as the electricity used to operate the factory equipment depreciation on the factory equipment and building factory supplies and factory personnel other than direct labor.

How these costs are assigned to products has an impact on the measurement of an individual product s profitability. Product cost are also factory costs period costs are the selling and administration costs. Some examples of manufacturing overhead costs include the following.

This overhead is applied to the units produced within a reporting period. Expert answer step 1 manufacturing cost. Examples of costs that are included in the manufacturing overhead category are.

Depreciation rent and property taxes on the manufacturing facilities depreciation on the manufacturing equipment managers and supervisors in the manufacturing facilities repairs and maintenance employees in the manufacturing. Factory insurance the factory supervisor s salary. It is a cost incurred for the production of a product like direct labor direct material and manufacturing overhead are the manufacturing related costs of a company.

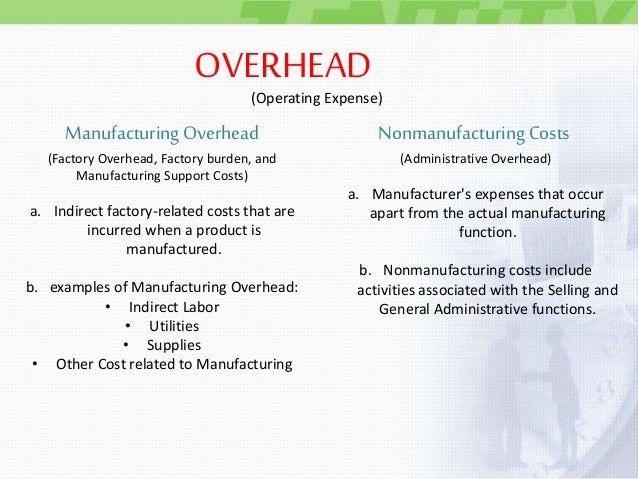

These types of manufacturing costs include raw materials direct labor variable overhead and fixed overhead. Manufacturing overhead manufacturing overhead or factory overhead is the overhead or indirect costs associated with manufacturing a product. Manufacturing costs consist of four basic types.

Manufacturing overhead is all indirect costs incurred during the production process. Manufacturing costs direct materials direct labor and manufacturing overhead. For example electricity for a factory would be included.

Direct materials the ceo s salary factory insurance office equipment depreciation the factory supervisor s salary. For example if you have a monthly depreciation expense of 1 600 and 1 000 of that is for manufacturing equipment only include the 1 000 in your monthly manufacturing overhead costs. The manufacturing costs of goods finished during the period.

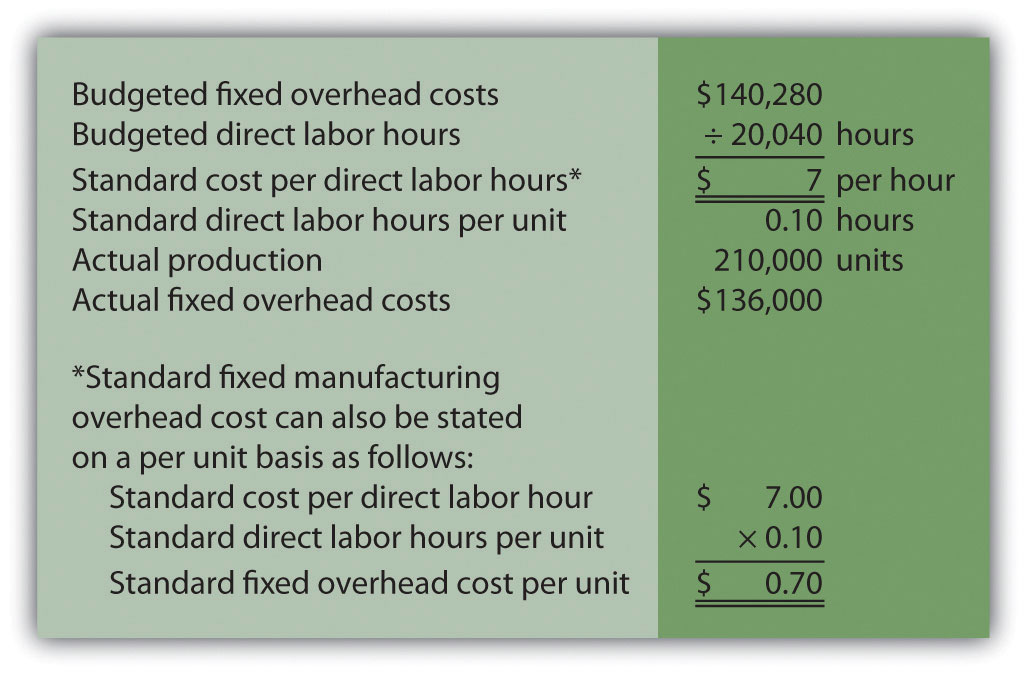

Fixed Manufacturing Overhead Variance Analysis

Fixed Manufacturing Overhead Variance Analysis

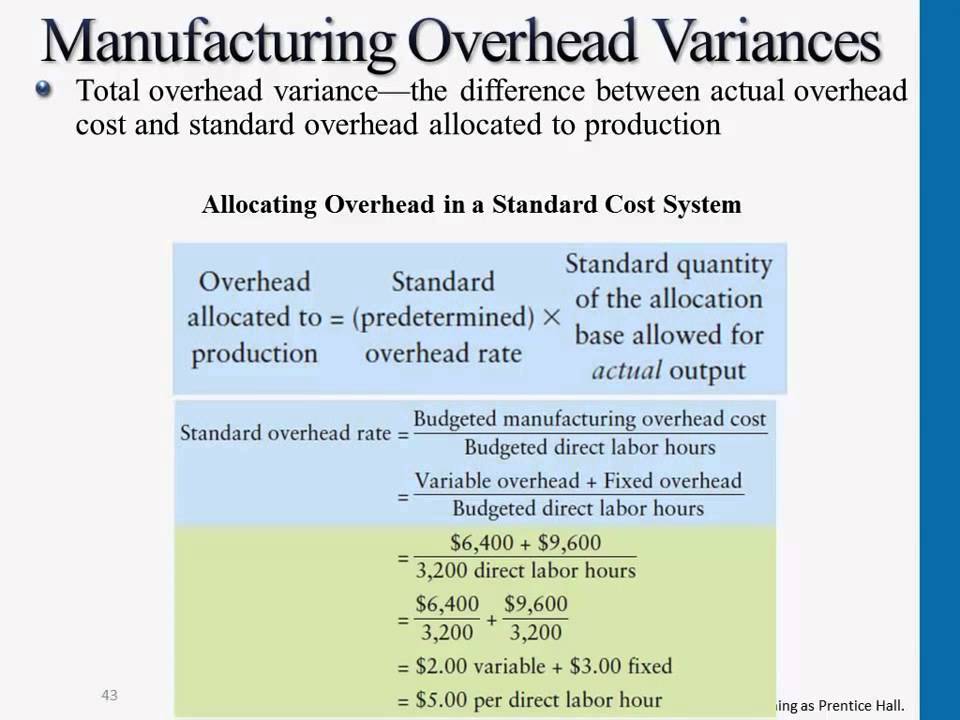

Manufacturing Overhead In A Standard Cost System Managerial

Manufacturing Overhead In A Standard Cost System Managerial

How To Reduce Manufacturing Overhead Costs Don T Use Abc Job

How To Reduce Manufacturing Overhead Costs Don T Use Abc Job

Manufacturing Overhead Formula Calculator With Excel Template

Manufacturing Overhead Formula Calculator With Excel Template

Manufacturing Overhead Double Entry Bookkeeping

Manufacturing Overhead Double Entry Bookkeeping

Traditional Methods Of Allocating Manufacturing Overhead

Traditional Methods Of Allocating Manufacturing Overhead

Product And Period Costs Double Entry Bookkeeping

Product And Period Costs Double Entry Bookkeeping

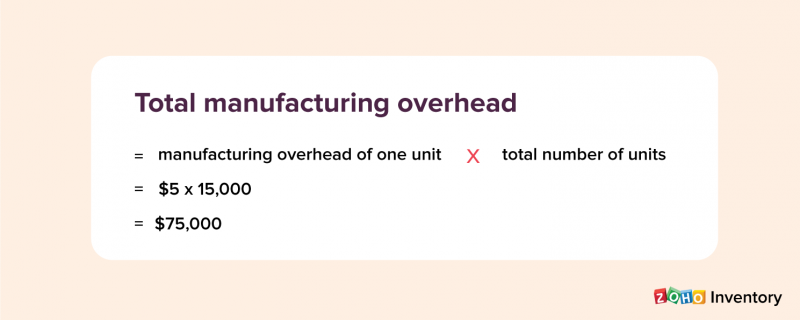

Manufacturing Overhead Formula Step By Step Calculation

Manufacturing Overhead Formula Step By Step Calculation

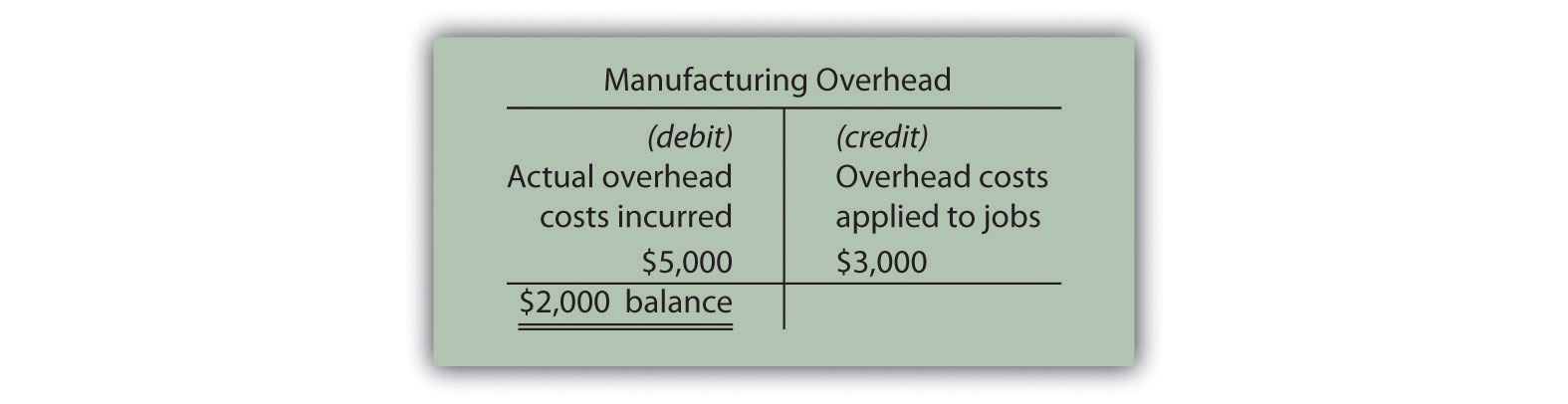

Accounting For Actual And Applied Overhead

Accounting For Actual And Applied Overhead

Solution Manual For Managerial Accounting 6th Edition By Jiambalvo

Solution Manual For Managerial Accounting 6th Edition By Jiambalvo

/TeslaQ2-19IncomeStatementInvestopedia-1466e66b056d48e6b1340bd5cae64602.jpg) Does Gross Profit Include Labor And Overhead

Does Gross Profit Include Labor And Overhead

18 Under Absorption Costing Product Costs Include Yes Variable

18 Under Absorption Costing Product Costs Include Yes Variable

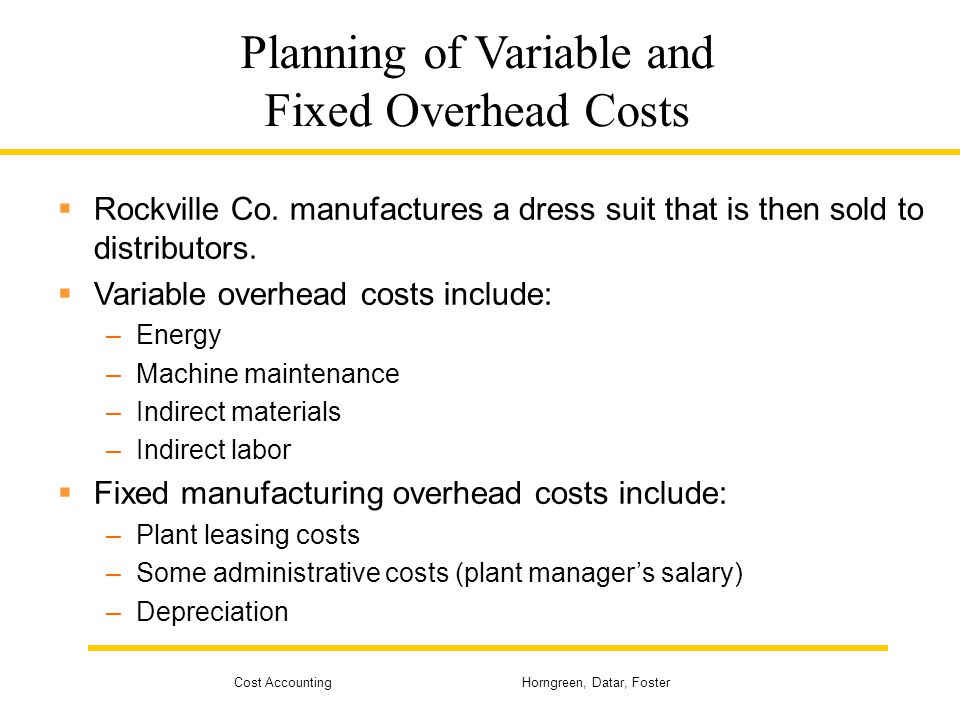

Flexible Budgets Variances And Management Control Ii Ppt Video

Flexible Budgets Variances And Management Control Ii Ppt Video

Assigning Manufacturing Overhead Costs To Jobs

Assigning Manufacturing Overhead Costs To Jobs

Manufacturing Overhead Formula Calculator With Excel Template

Manufacturing Overhead Formula Calculator With Excel Template

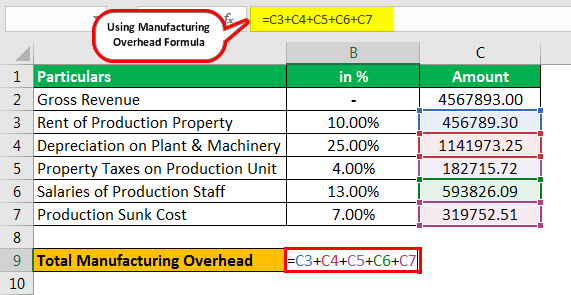

Manufacturing Overhead Definition Examples Top 2 Types

Manufacturing Overhead Definition Examples Top 2 Types

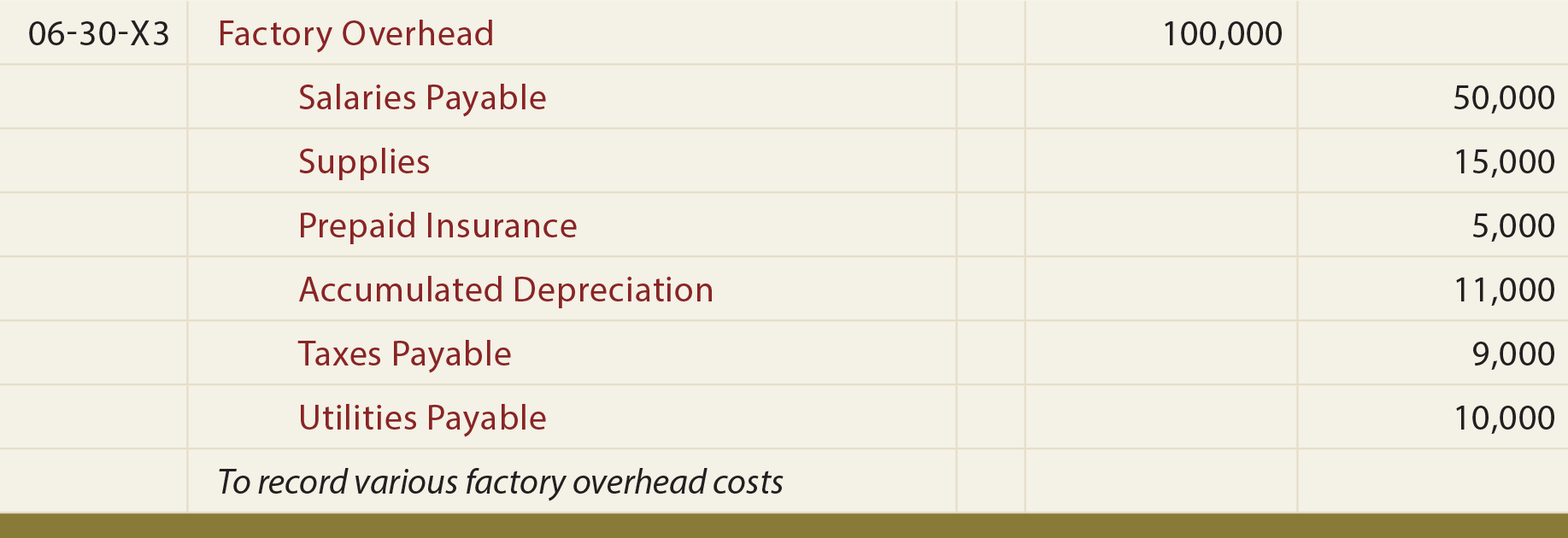

Accounting For Factory Overhead

Accounting For Factory Overhead

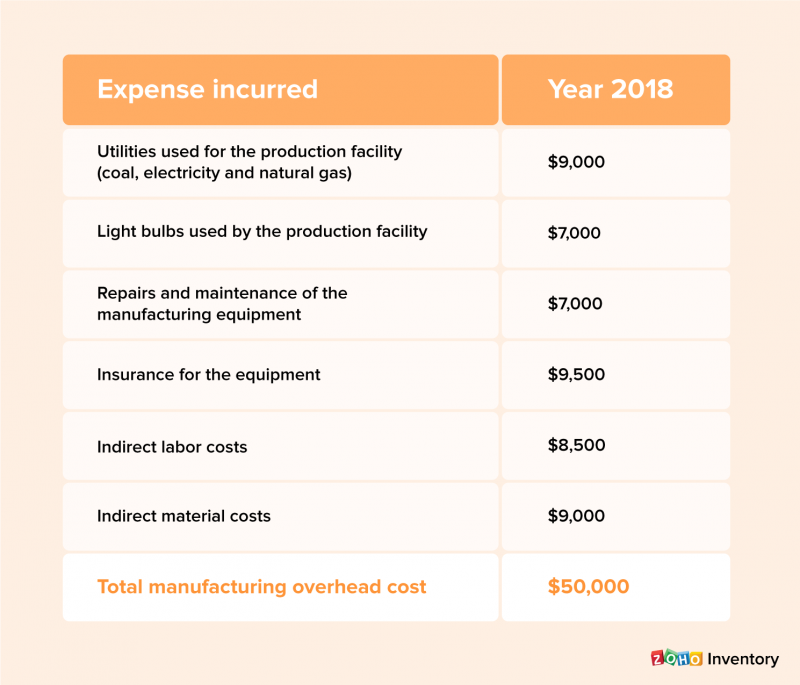

Manufacturing Overhead Cost How To Calculate Moh Cost Zoho

Manufacturing Overhead Cost How To Calculate Moh Cost Zoho

Variable Overhead Standard Cost And Variances Accountingcoach

Variable Overhead Standard Cost And Variances Accountingcoach

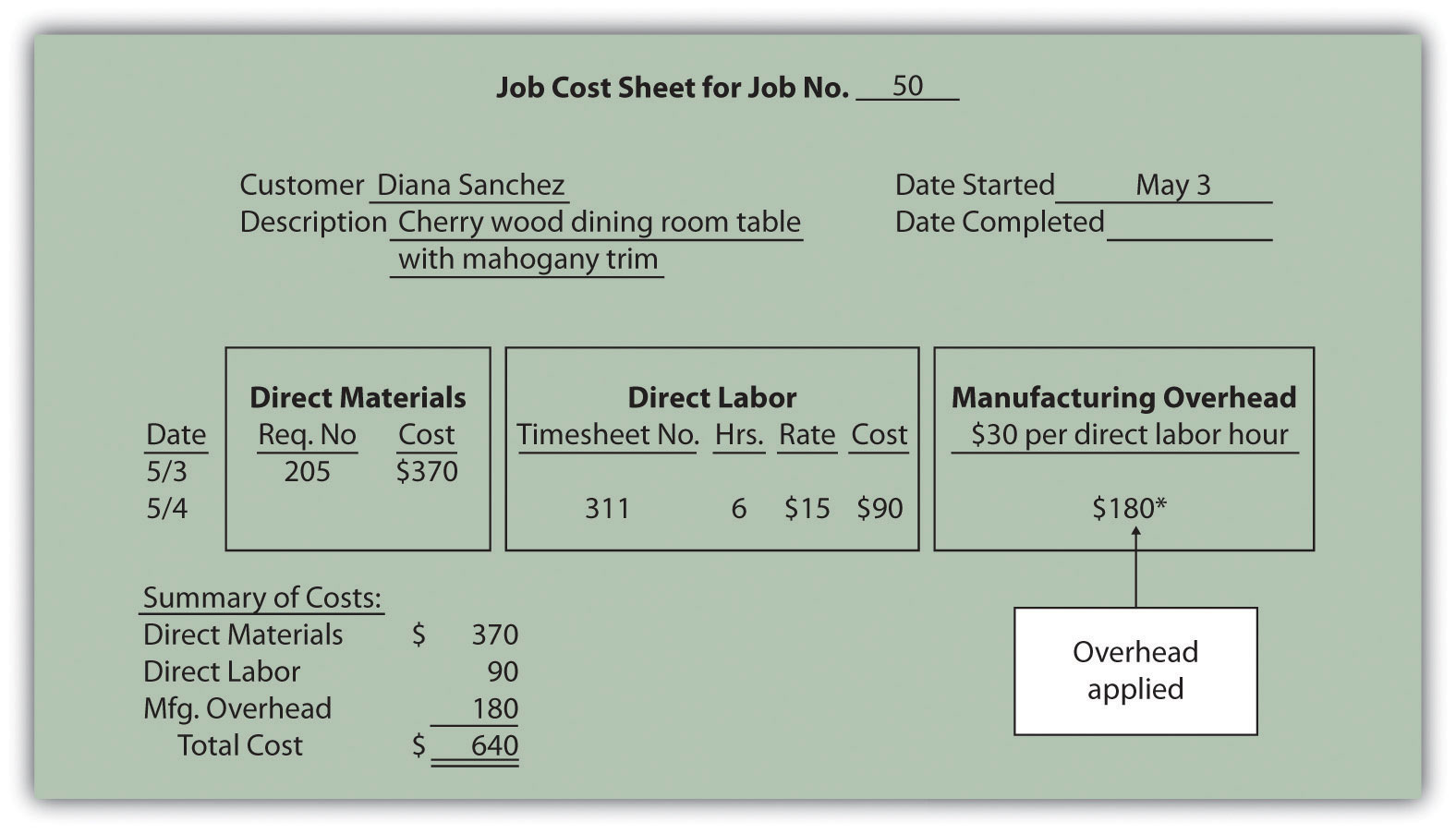

Assigning Manufacturing Overhead Costs To Jobs Accounting For

Assigning Manufacturing Overhead Costs To Jobs Accounting For

Assigning Manufacturing Overhead Costs To Jobs Accounting For

Assigning Manufacturing Overhead Costs To Jobs Accounting For

Overhead Rates And Absorption Versus Variable Costing Cma

Manufacturing Overhead Formula Step By Step Calculation

Manufacturing Overhead Formula Step By Step Calculation

Manufacturing Overhead Cost How To Calculate Moh Cost Zoho

Manufacturing Overhead Cost How To Calculate Moh Cost Zoho

What S The Difference Between Direct Vs Indirect Costs

What S The Difference Between Direct Vs Indirect Costs

Introduction To Managerial Accounting And Cost Concepts

Introduction To Managerial Accounting And Cost Concepts

Product Costs Types Of Costs Examples Materials Labor Overhead

Product Costs Types Of Costs Examples Materials Labor Overhead

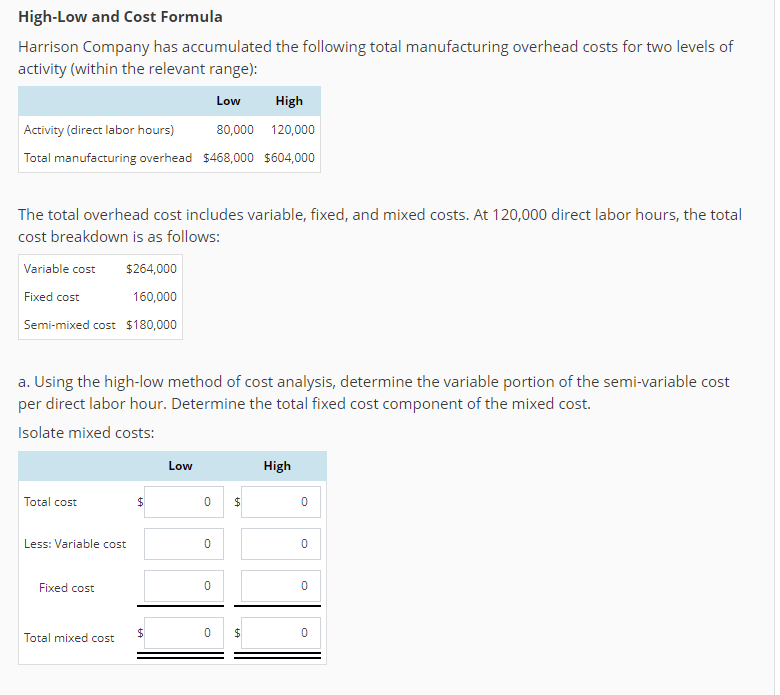

Solved Harrison Company Has Accumulated The Following Tot

Solved Harrison Company Has Accumulated The Following Tot

Variable Overhead Standard Cost And Variances Accountingcoach

Variable Overhead Standard Cost And Variances Accountingcoach

Traditional Methods Of Allocating Manufacturing Overhead

Traditional Methods Of Allocating Manufacturing Overhead

Solved High Low And Cost Formula Harrison Company Has Acc

Solved High Low And Cost Formula Harrison Company Has Acc

Manufacturing Overhead Formula Calculator With Excel Template

Manufacturing Overhead Formula Calculator With Excel Template

Manufacturing Overhead Formula Step By Step Calculation

Manufacturing Overhead Formula Step By Step Calculation

Solved High Low And Cost Formula Harrison Company Has Acc

Solved High Low And Cost Formula Harrison Company Has Acc

Fixed Overhead Standard Cost And Variances Accountingcoach

Fixed Overhead Standard Cost And Variances Accountingcoach

Overhead Budget Meaning Example Of Manufacturing Overhead Budget

Overhead Budget Meaning Example Of Manufacturing Overhead Budget

What Is Total Manufacturing Cost Definition Meaning Example

What Is Total Manufacturing Cost Definition Meaning Example

Posting Komentar

Posting Komentar