How Do You Calculate Manufacturing Overhead

Overhead rate overhead costs sales. While some of these costs are fixed such as the rent of the factory.

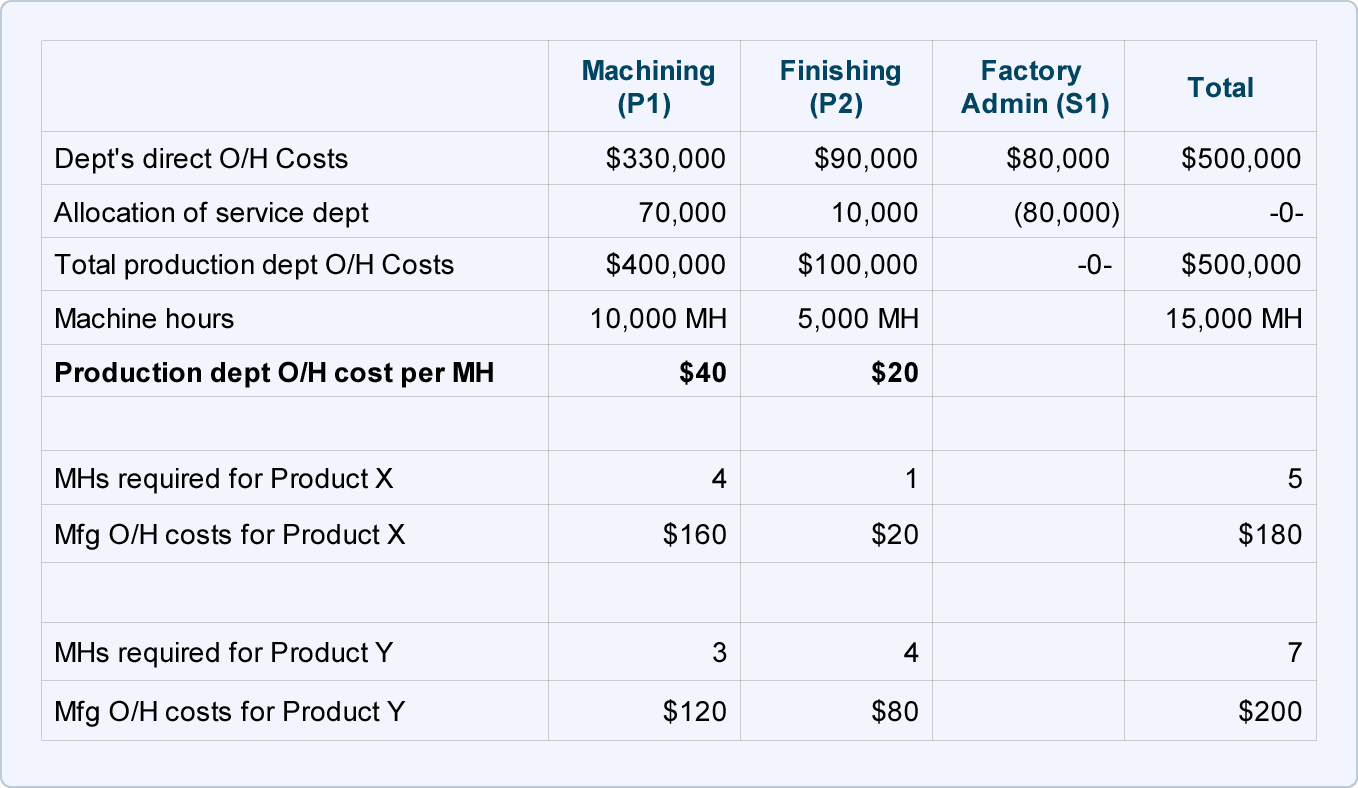

Traditional Methods Of Allocating Manufacturing Overhead

Traditional Methods Of Allocating Manufacturing Overhead

For example say your business had 10 000 in overhead costs in a month and 50 000 in sales.

How do you calculate manufacturing overhead. Next determine the cost of raw material which includes the cost of raw material purchase. Rent of the factory building. Manufacturing overhead formula depreciation expenses on equipment used in production.

Before you can calculate manufacturing overhead for wip you need to. Utilities of the factory. Multiply this number by 100 to get your overhead rate.

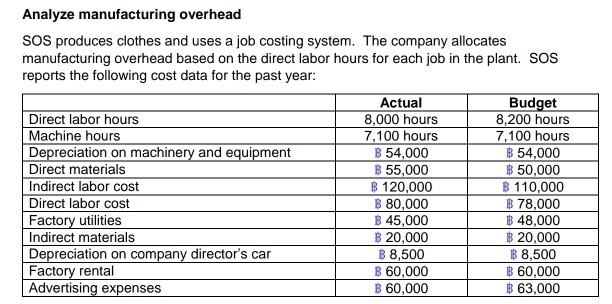

To calculate manufacturing overhead you add up all indirect costs that are related to operating your factory then divide the sum and allocate it to every unit that you produce. Add up total overhead. The allocation base is the basis on which a business assigns overhead costs to products.

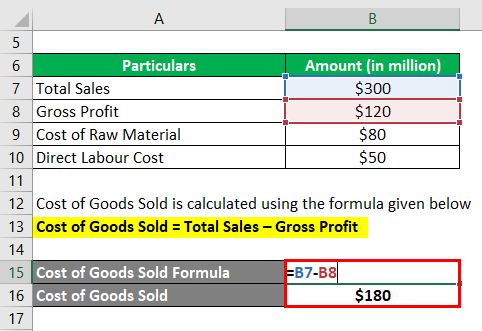

Manufacturing overhead is the term used to designate indirect. Firstly determine the cost of goods sold which includes all direct and indirect costs of production. Select an allocation base.

To calculate the overhead rate divide the total overhead costs of the business in a month by its monthly sales. Wages salaries of manufacturing managers. How these costs are assigned to products has an impact on the measurement of an individual product s profitability.

For example calculating applied manufacturing overhead means that you are including some of the overhead operating expenses of your manufacturing facility and equipment into the cost of the products you manufacture. Remember that overhead allocation entails three steps. Manufacturing overhead and work in process.

Property taxes paid for a production unit. This formula is useful to businesses that do not have a significant financial security and wish to reduce costs. To assign overhead costs to individual units you need to compute an overhead allocation rate.

You know that total overhead is expected to come to 400. Having an accurate idea of expenses makes it possible to more accurately determine and predict profit margins now and into the. The formula for manufacturing overhead can be derived by using the following steps.

Manufacturing overhead includes such things as the electricity used to operate the factory equipment depreciation on the factory equipment and building factory supplies and factory personnel other than direct labor. How do you calculate allocated manufacturing overhead. Wages salaries of material managing staff.

Add up estimated indirect materials indirect labor and all other product costs not included in direct materials and direct labor. How to calculate manufacturing overhead for work in process with beginning ending balances overview. Now plug these numbers into the following equation.

Calculate the total manufacturing overhead costs. Compute the overhead allocation rate by dividing total overhead by the number of direct labor hours. Add up the direct labor hours associated with each product 120 hours for product j 40 hours for product k 160 total hours.

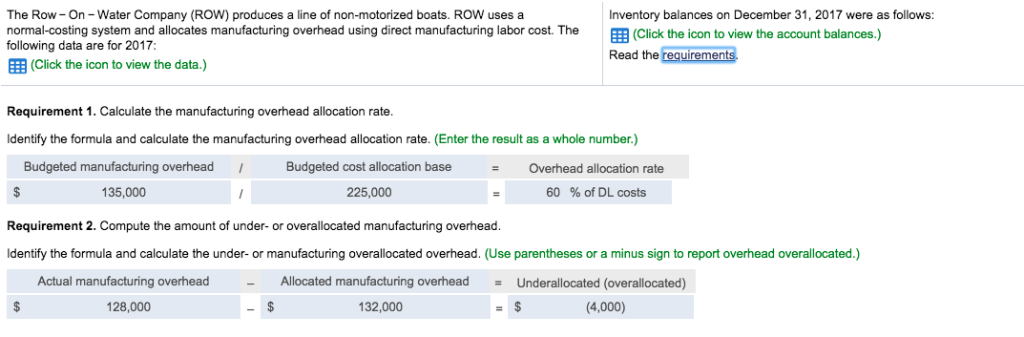

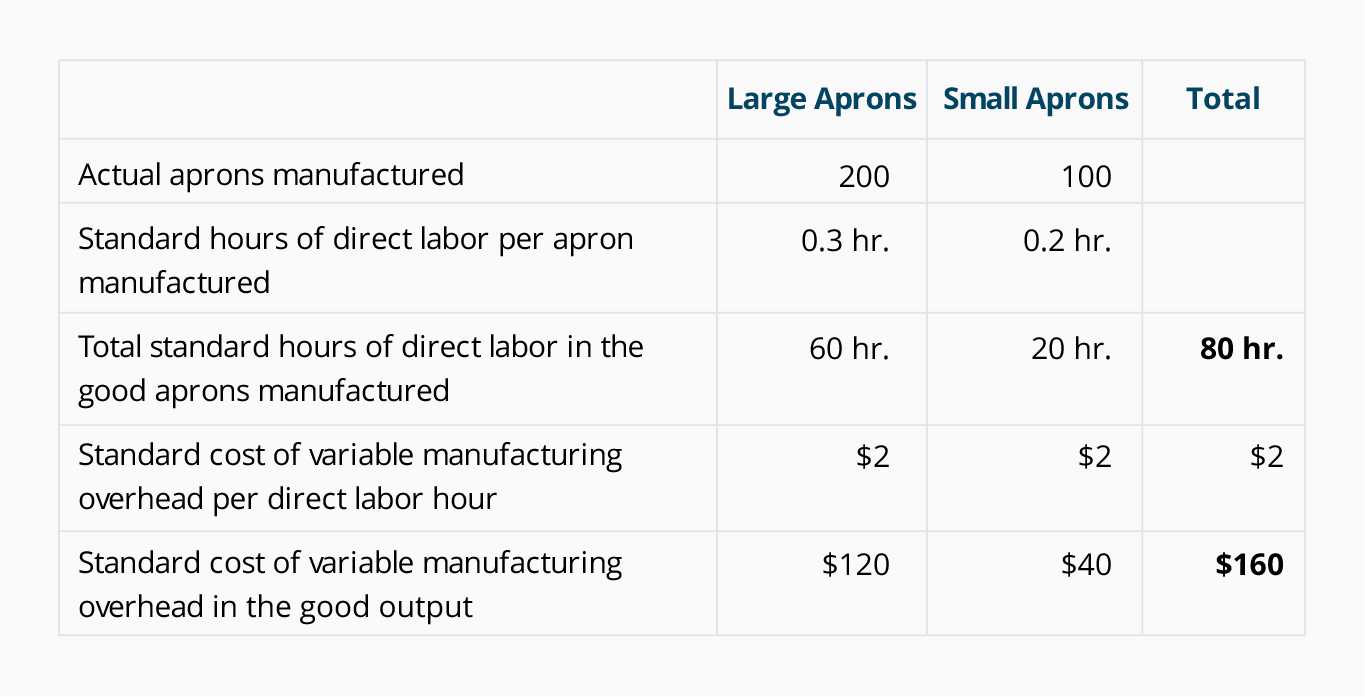

Solved The Row On Water Company Row Produces A Line Of

Solved The Row On Water Company Row Produces A Line Of

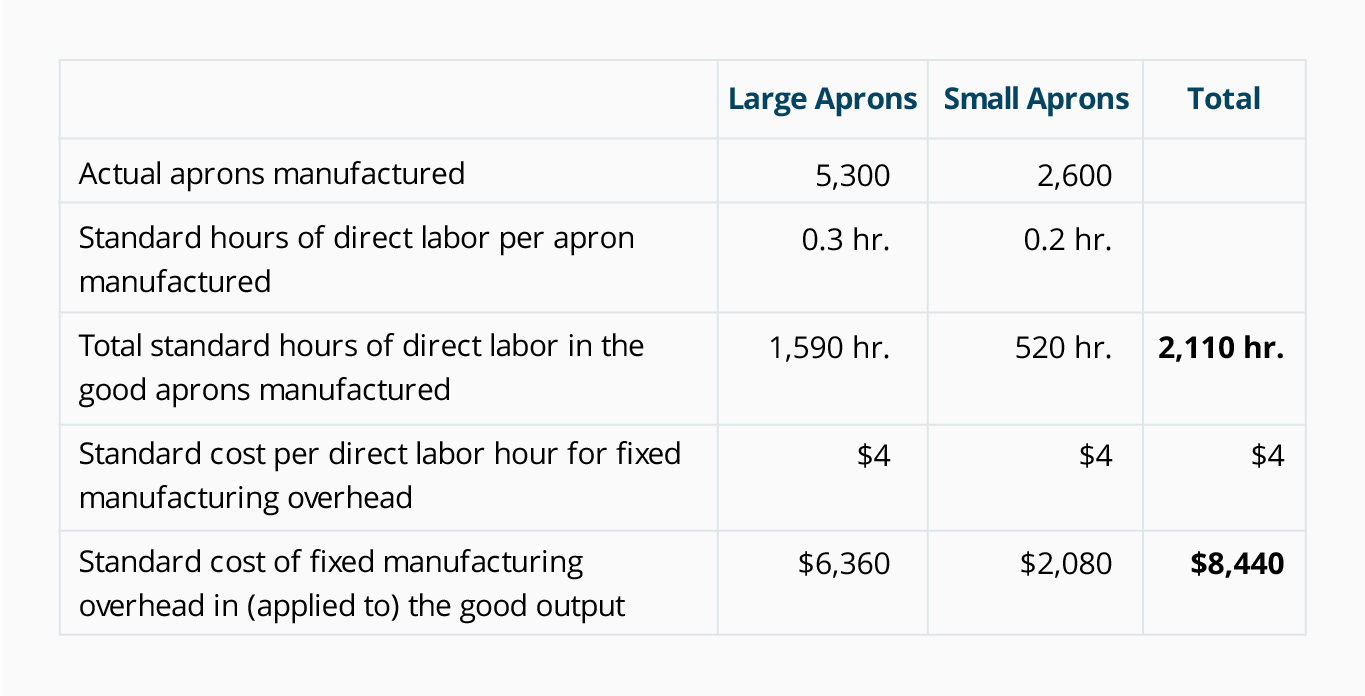

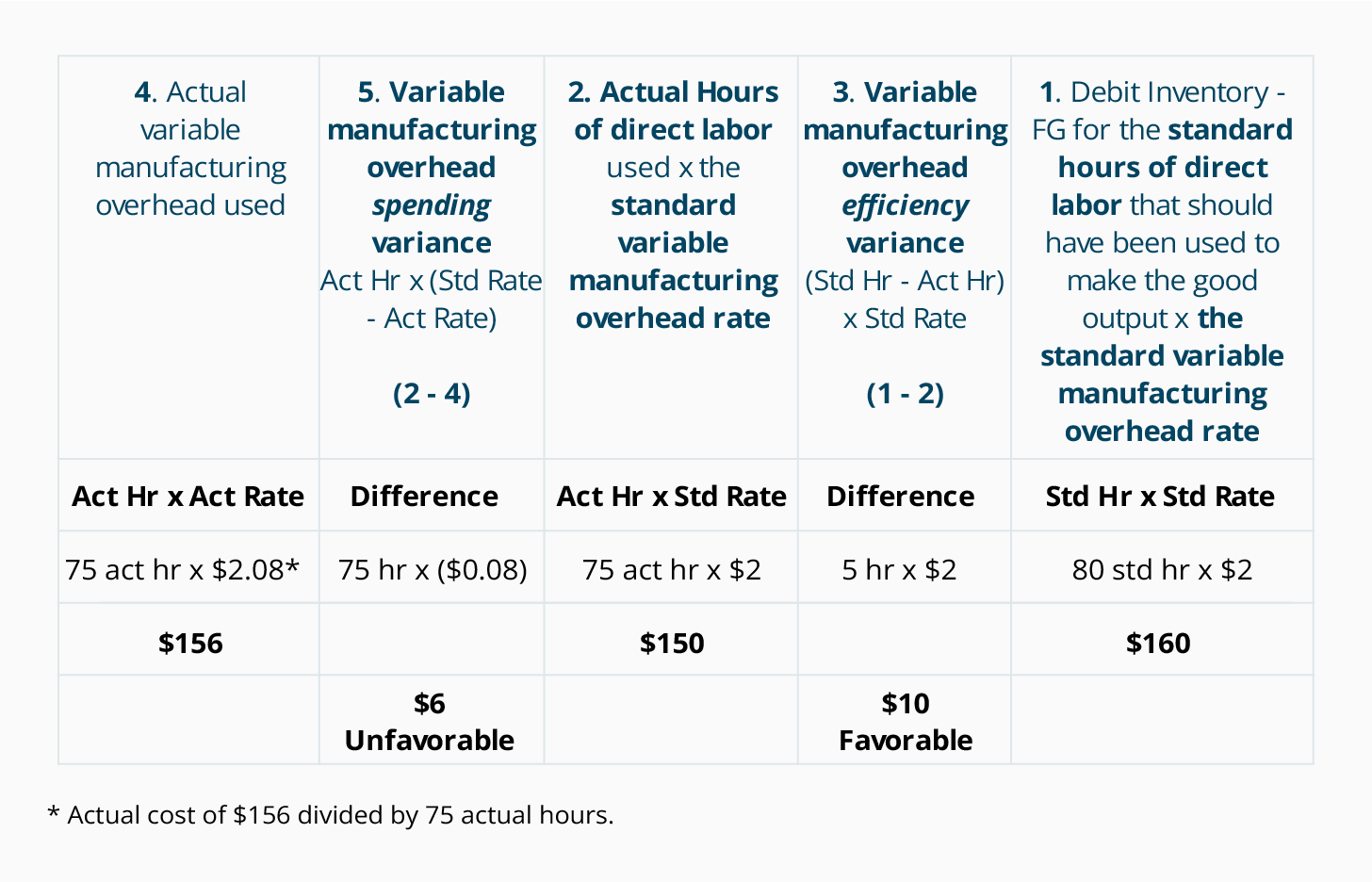

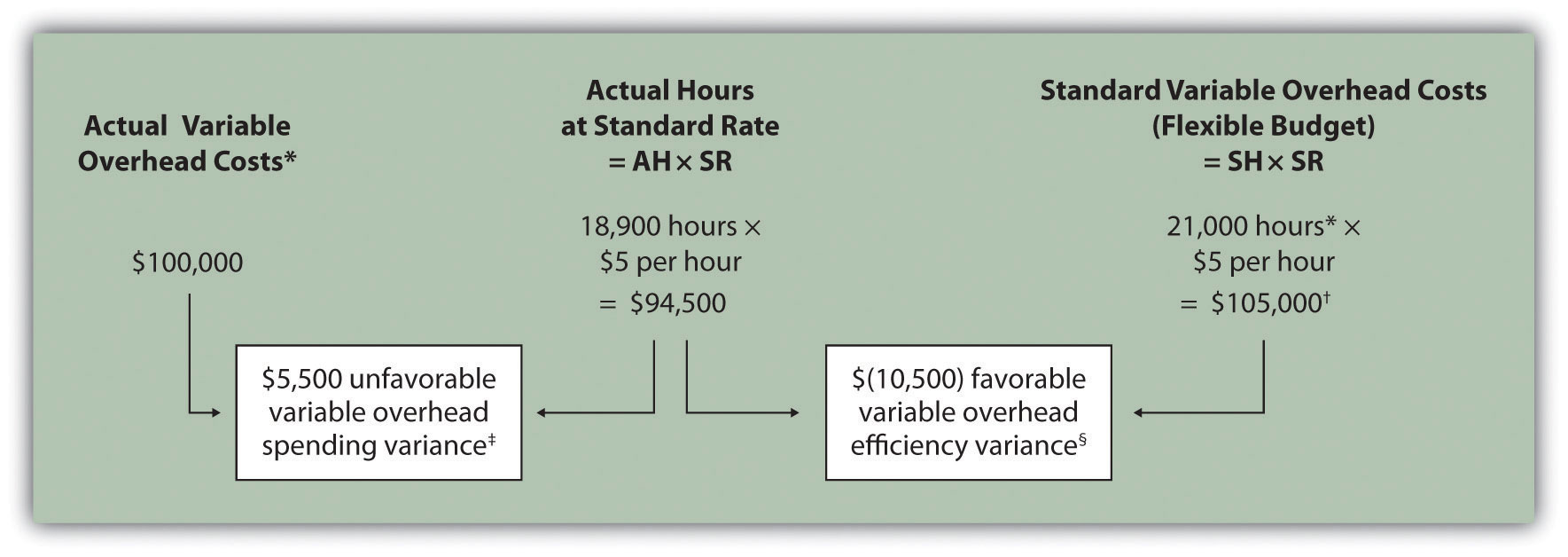

Variable Overhead Standard Cost And Variances Accountingcoach

Variable Overhead Standard Cost And Variances Accountingcoach

Fixed Manufacturing Overhead Variance Analysis Accounting For

Fixed Manufacturing Overhead Variance Analysis Accounting For

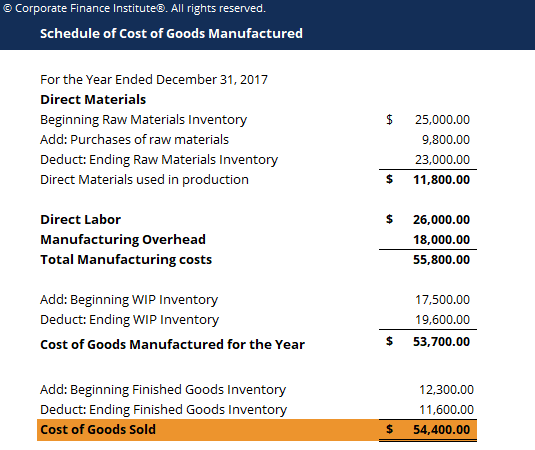

Cost Of Goods Manufactured Cogm How To Calculate Cogm

Cost Of Goods Manufactured Cogm How To Calculate Cogm

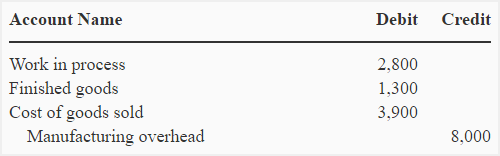

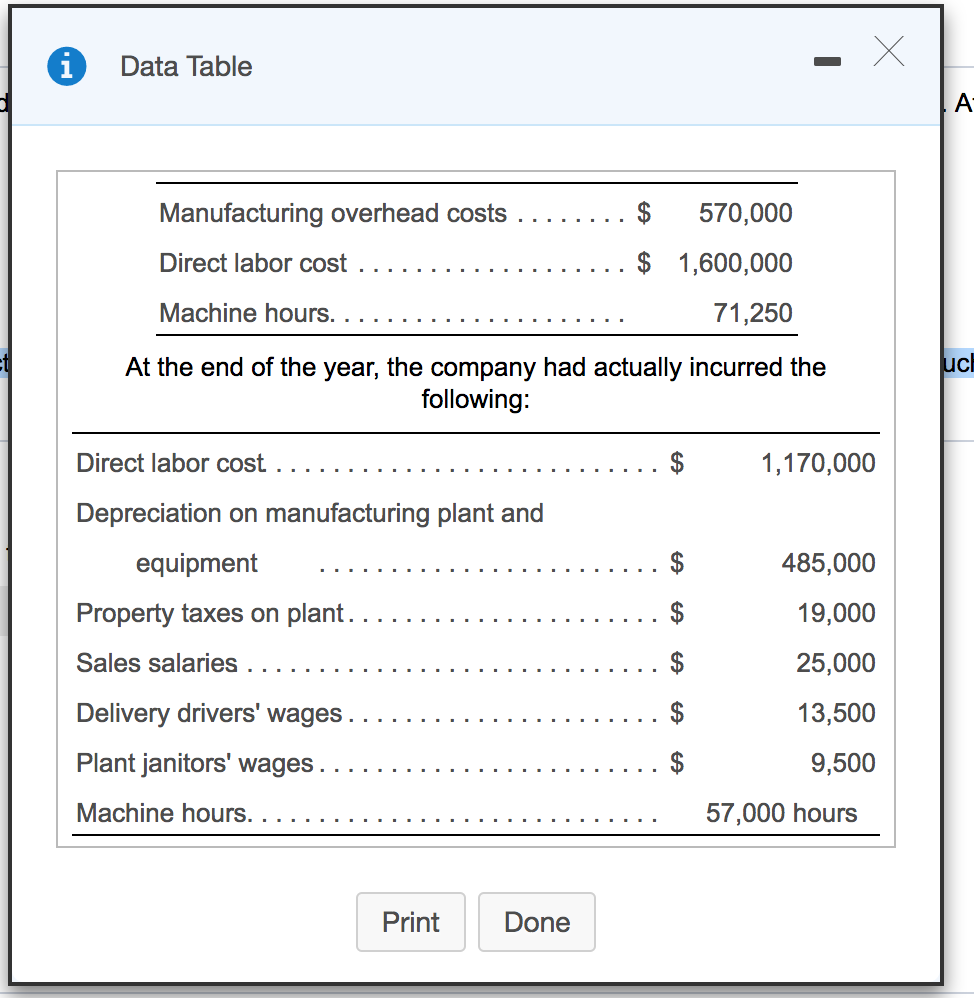

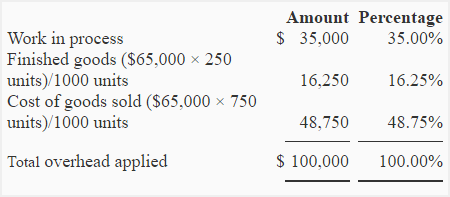

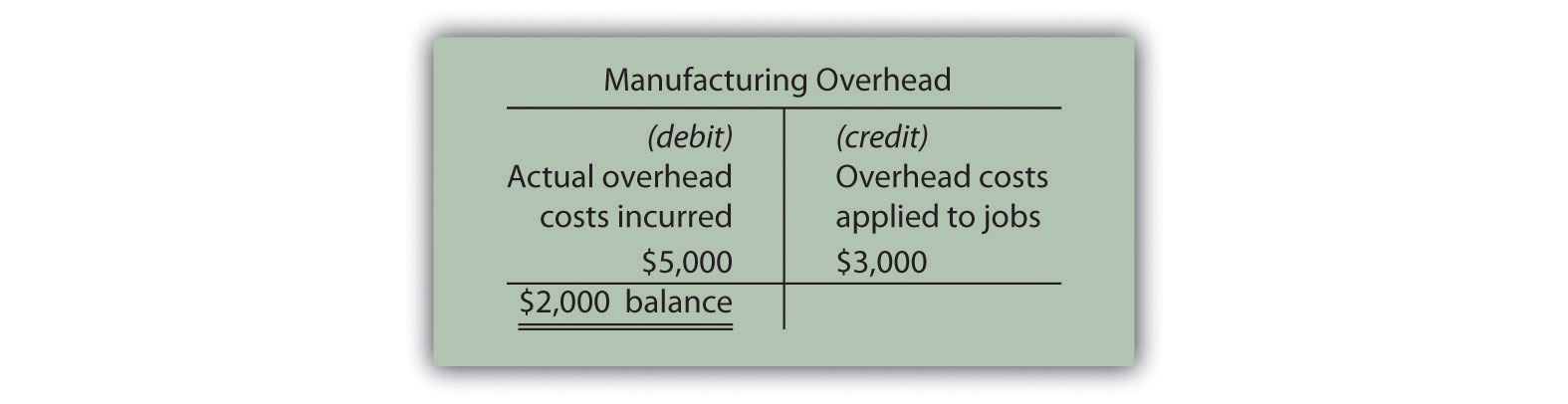

Over Or Under Applied Manufacturing Overhead Explanation

Over Or Under Applied Manufacturing Overhead Explanation

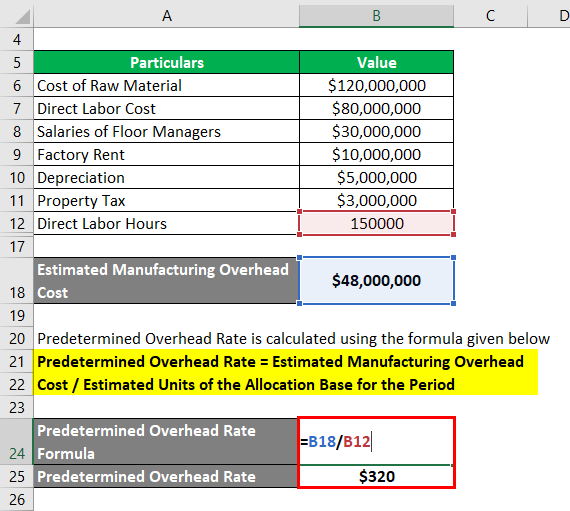

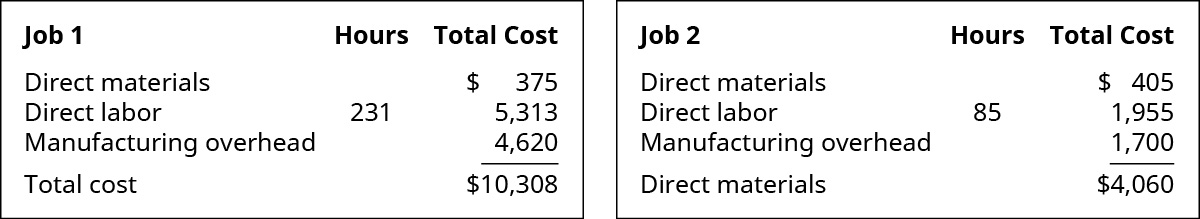

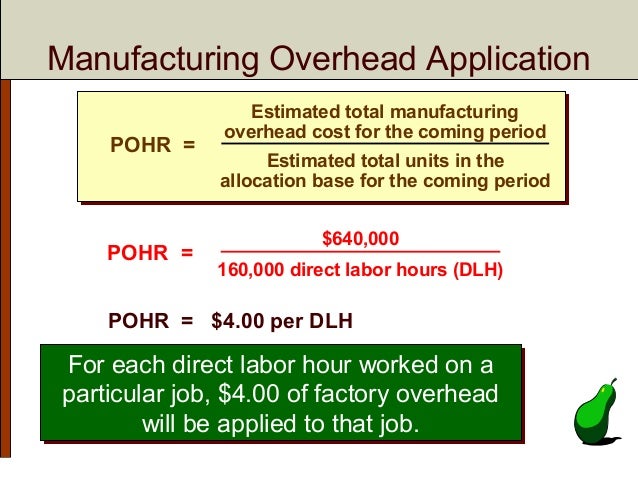

6 1 Calculate Predetermined Overhead And Total Cost Under The

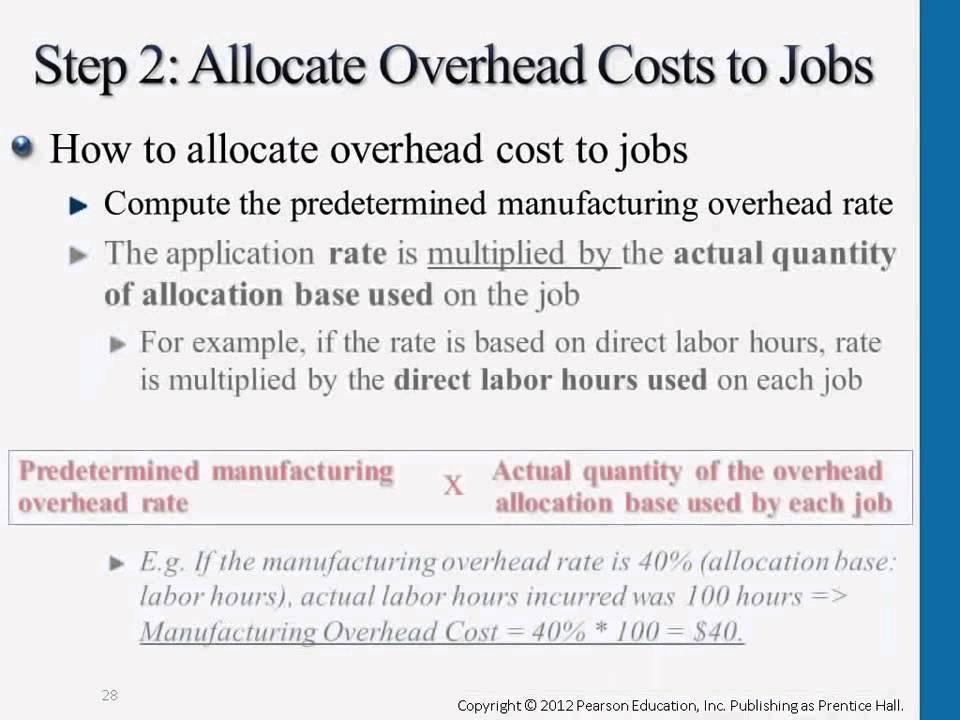

Assigning Manufacturing Overhead To Jobs Youtube

Assigning Manufacturing Overhead To Jobs Youtube

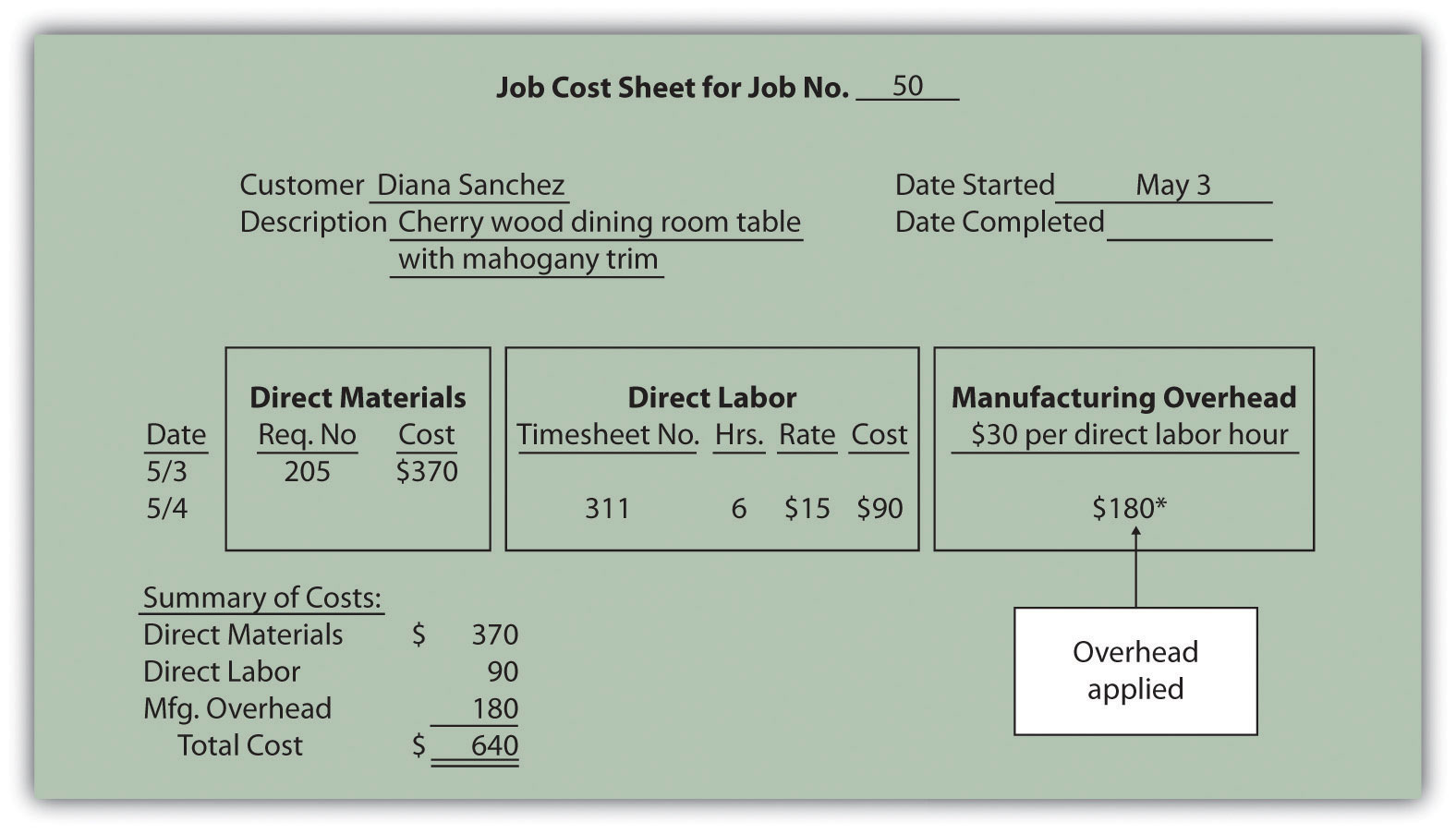

Assigning Manufacturing Overhead Costs To Jobs

Assigning Manufacturing Overhead Costs To Jobs

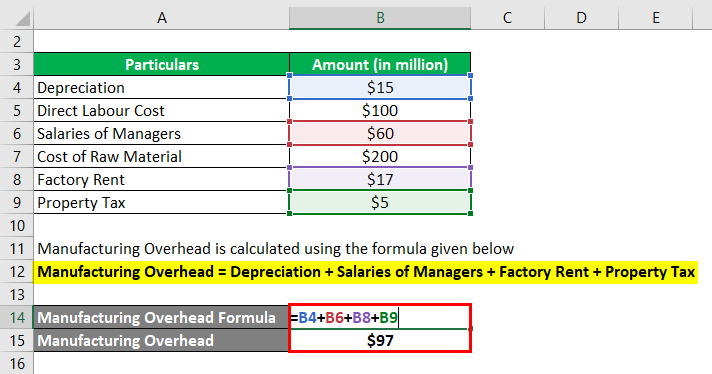

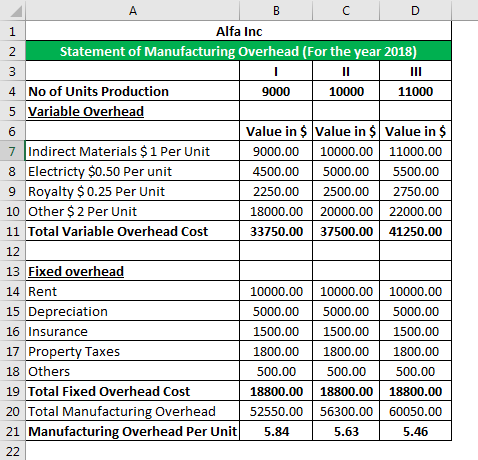

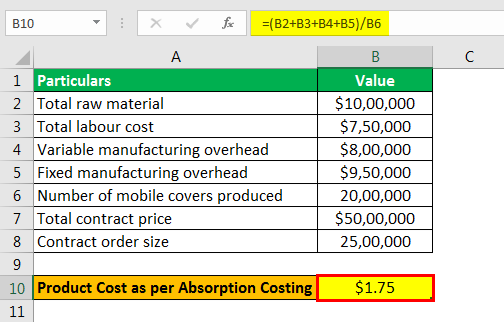

Manufacturing Overhead Formula Calculator With Excel Template

Manufacturing Overhead Formula Calculator With Excel Template

Overhead Rates And Absorption Versus Variable Costing Cma

Variable Overhead Standard Cost And Variances Accountingcoach

Variable Overhead Standard Cost And Variances Accountingcoach

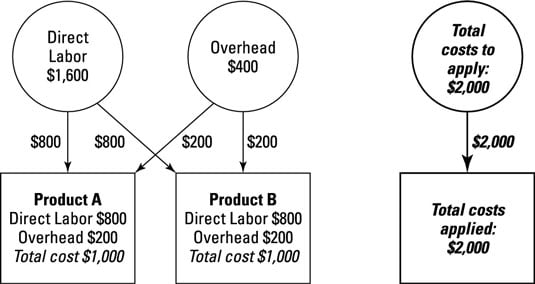

How To Calculate Overhead Allocation Dummies

How To Calculate Overhead Allocation Dummies

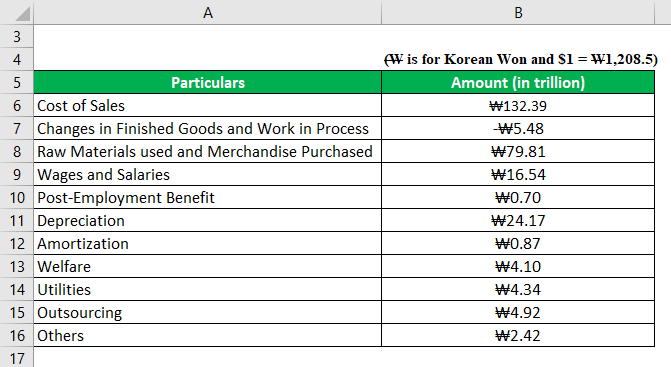

Manufacturing Overhead Costs Traditional Cost System Download Table

Manufacturing Overhead Costs Traditional Cost System Download Table

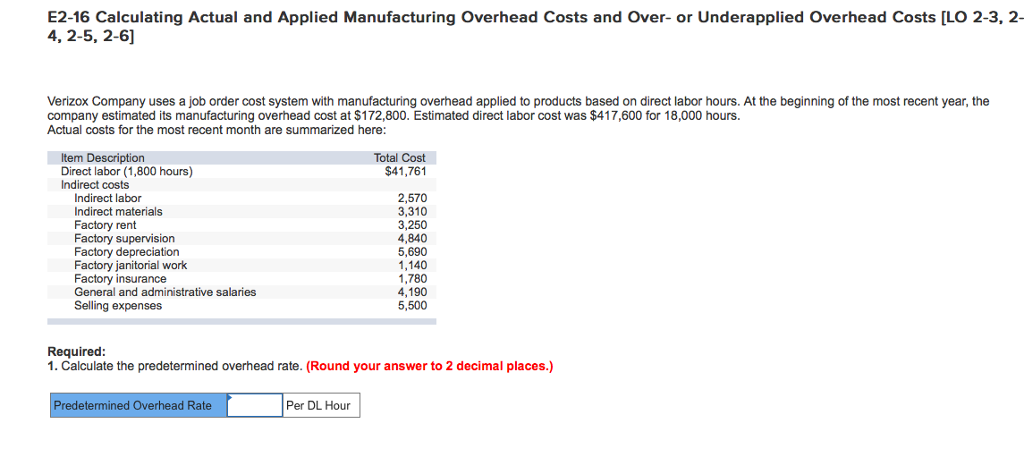

Solved E2 16 Calculating Actual And Applied Manufacturing

Solved E2 16 Calculating Actual And Applied Manufacturing

Applied Overhead Predetermined Rate Double Entry Bookkeeping

Applied Overhead Predetermined Rate Double Entry Bookkeeping

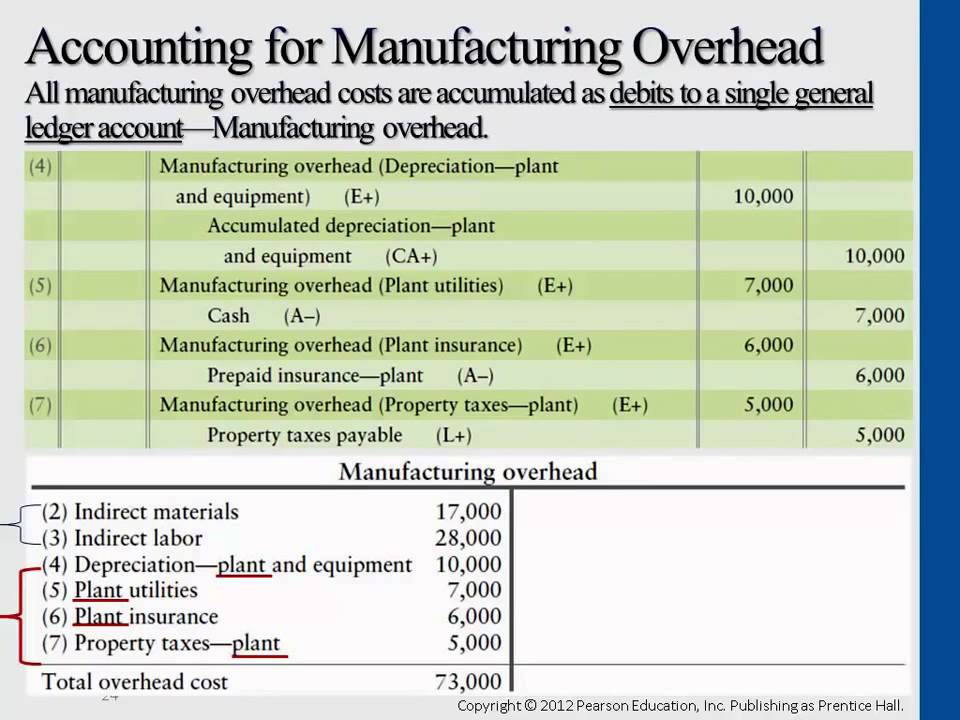

Accounting For Manufacturing Overhead Youtube

Accounting For Manufacturing Overhead Youtube

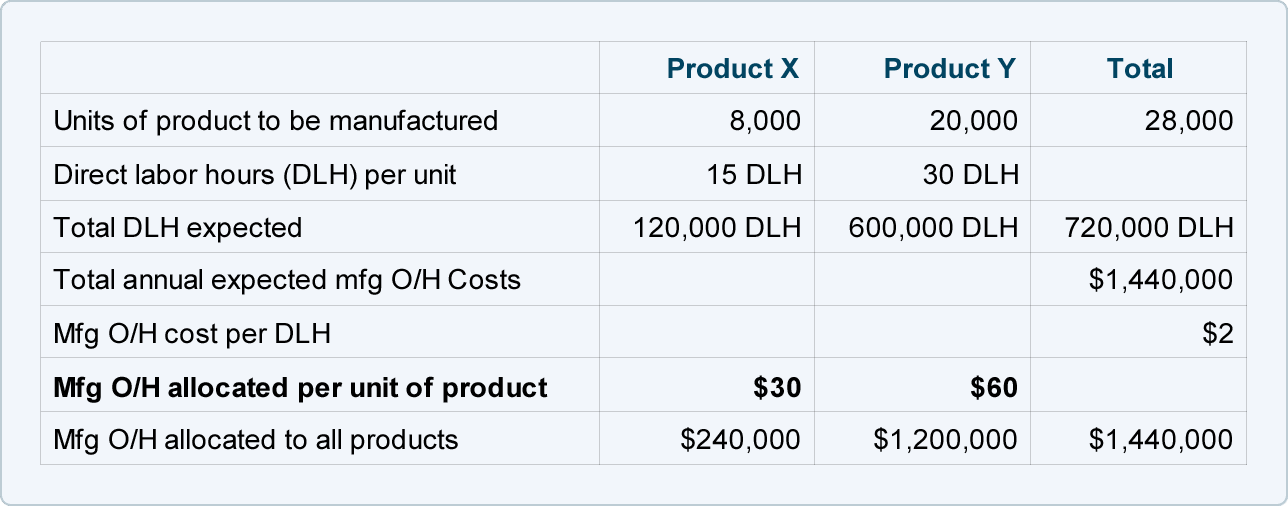

Traditional Methods Of Allocating Manufacturing Overhead

Traditional Methods Of Allocating Manufacturing Overhead

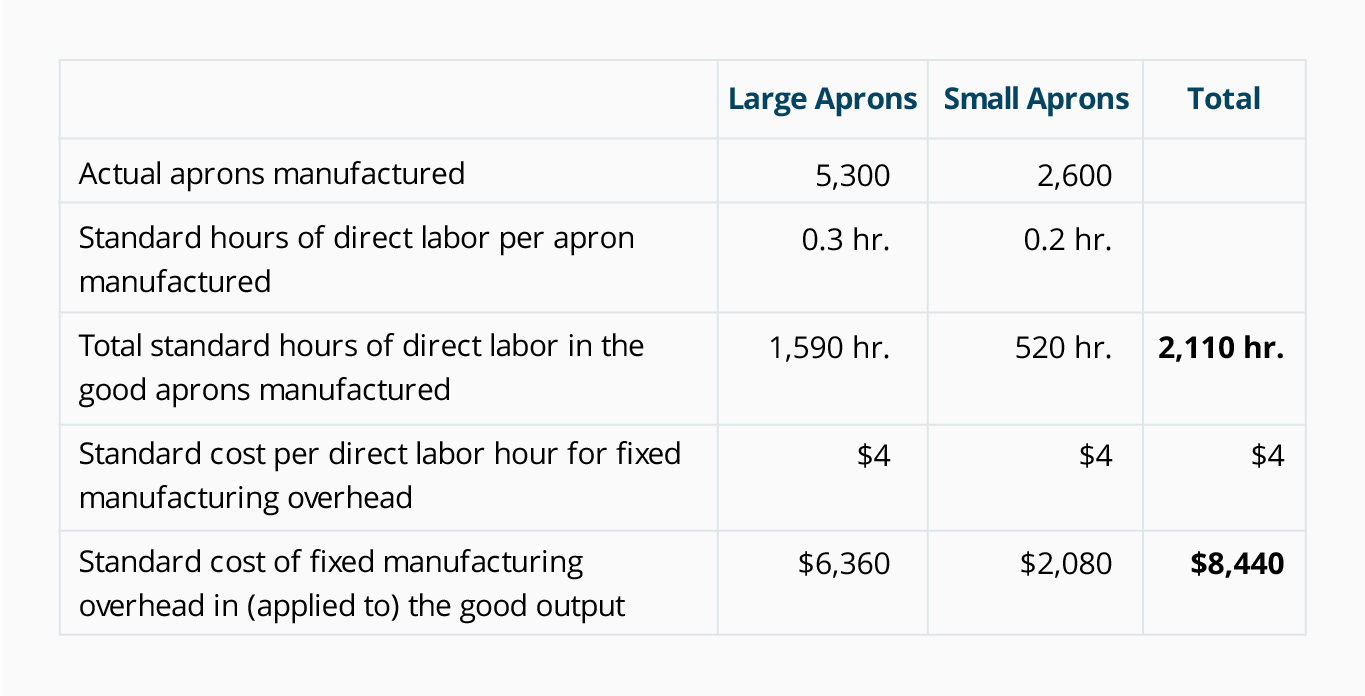

Fixed Overhead Standard Cost And Variances Accountingcoach

Fixed Overhead Standard Cost And Variances Accountingcoach

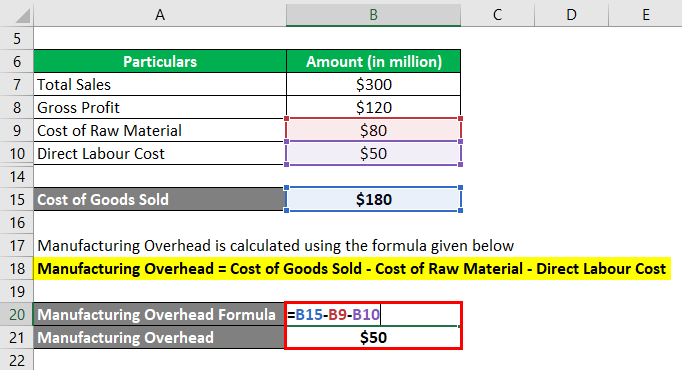

Manufacturing Overhead Formula Calculator With Excel Template

Manufacturing Overhead Formula Calculator With Excel Template

Manufacturing Overhead Formula Calculator With Excel Template

Manufacturing Overhead Formula Calculator With Excel Template

Manufacturing Overhead Costs Traditional Cost System Download Table

Manufacturing Overhead Costs Traditional Cost System Download Table

Solved 1 Compute Flores Flores Predetermined Manufactur

Solved 1 Compute Flores Flores Predetermined Manufactur

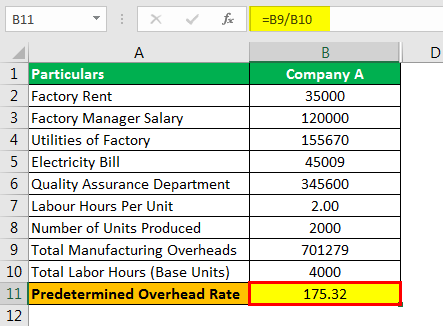

Predetermined Overhead Rate Formula Calculator With Excel Template

Predetermined Overhead Rate Formula Calculator With Excel Template

Manufacturing Overhead Formula Calculator With Excel Template

Manufacturing Overhead Formula Calculator With Excel Template

Manufacturing Overhead Definition Examples Top 2 Types

Manufacturing Overhead Definition Examples Top 2 Types

Compute A Predetermined Overhead Rate And Apply Overhead To

Compute A Predetermined Overhead Rate And Apply Overhead To

Predetermined Overhead Rate Formula How To Calculate

Predetermined Overhead Rate Formula How To Calculate

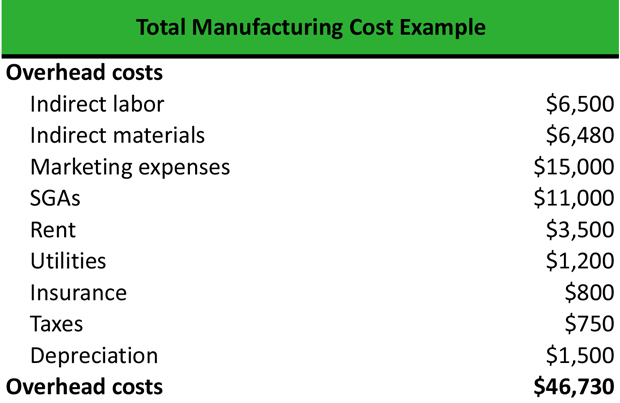

What Is Total Manufacturing Cost Definition Meaning Example

What Is Total Manufacturing Cost Definition Meaning Example

Variable Manufacturing Overhead Variance Analysis

Variable Manufacturing Overhead Variance Analysis

Manufacturing Overhead Formula Step By Step Calculation

Manufacturing Overhead Formula Step By Step Calculation

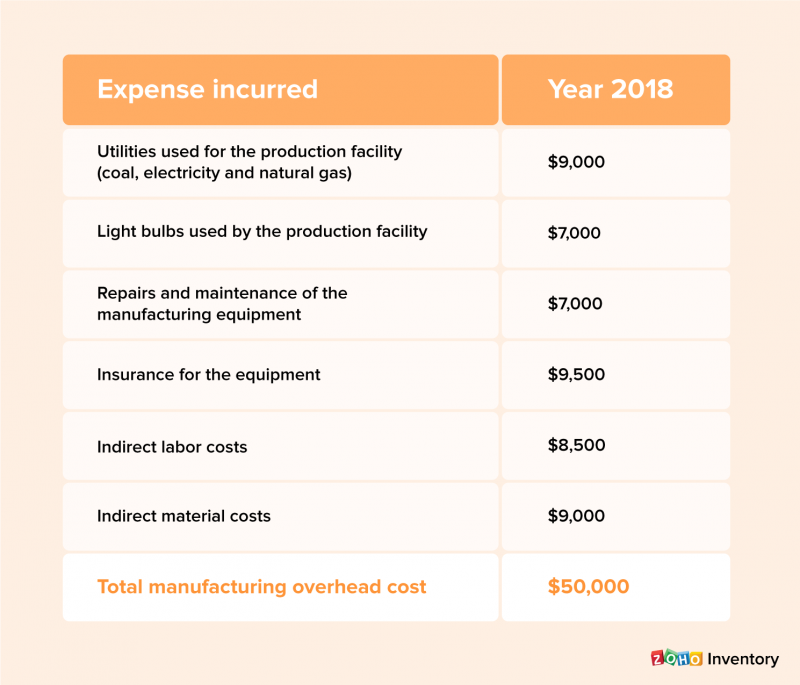

Manufacturing Overhead Cost How To Calculate Moh Cost Zoho

Manufacturing Overhead Cost How To Calculate Moh Cost Zoho

Manufacturing Overhead Formula Calculator With Excel Template

Manufacturing Overhead Formula Calculator With Excel Template

Over Or Under Applied Manufacturing Overhead Explanation

Over Or Under Applied Manufacturing Overhead Explanation

Absorption Costing Definition Formula How To Calculate

Absorption Costing Definition Formula How To Calculate

Assigning Manufacturing Overhead Costs To Jobs Accounting For

Assigning Manufacturing Overhead Costs To Jobs Accounting For

Posting Komentar

Posting Komentar