Aging Of Accounts Receivable Method

The idea behind this technique is classification of accounts receivables into an aging schedule. The classification of accounts receivable in the accounts receivable aging schedule also helps the business to identify the customers who take longer to pay so that they can restrict sales to those customers to reduce risk of bad debts.

Solved Wechsler Company Uses The Aging Of Accounts Receiv Chegg Com

Solved Wechsler Company Uses The Aging Of Accounts Receiv Chegg Com

For example you may allow clients to pay goods 30 days after they are delivered.

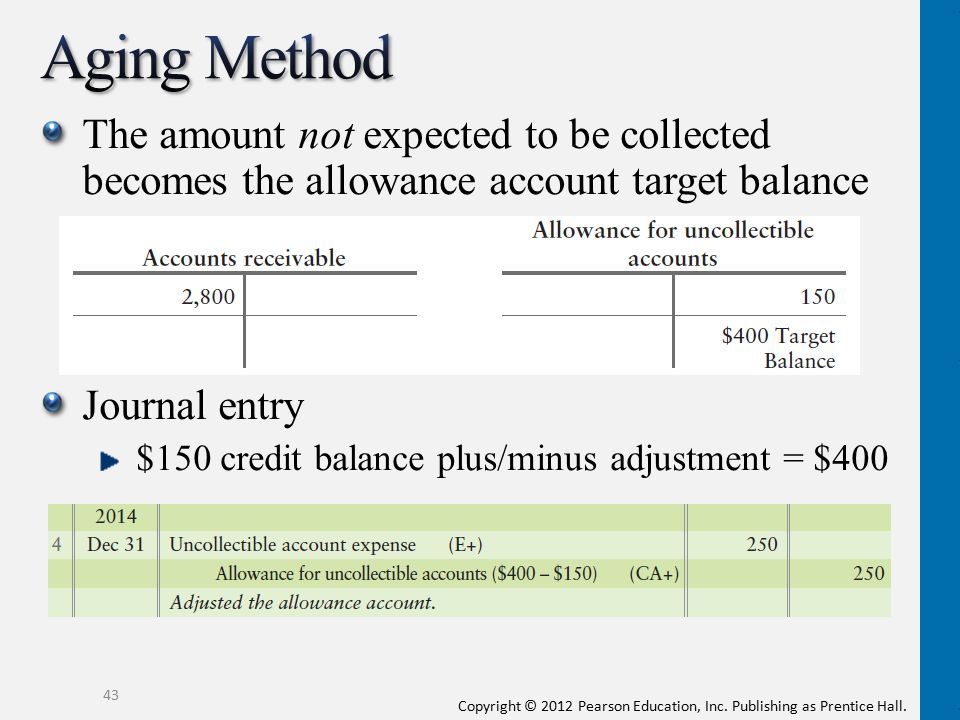

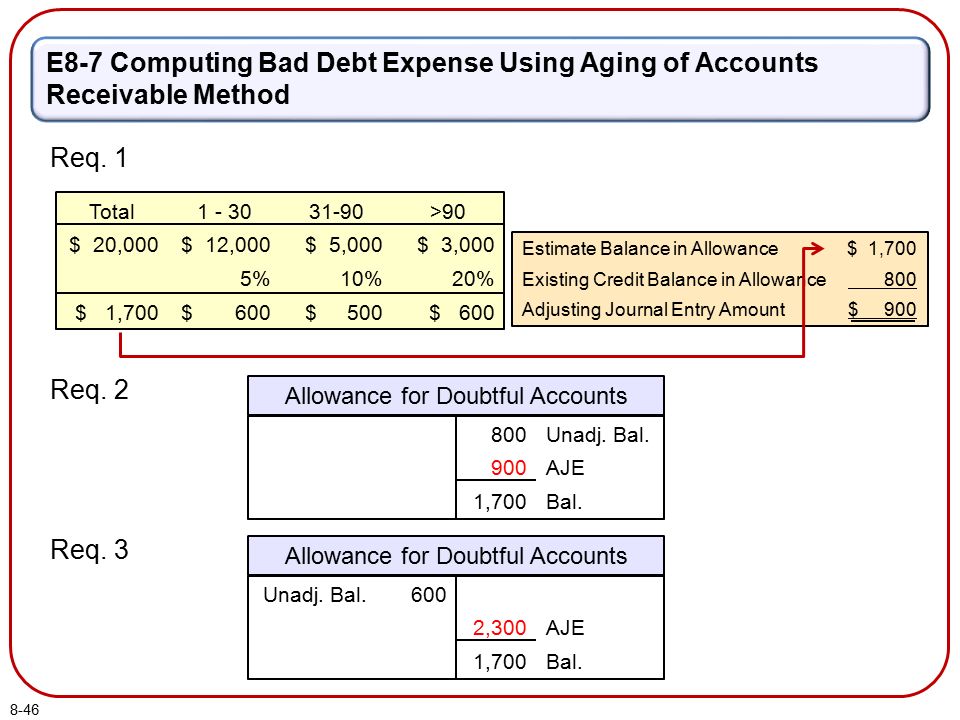

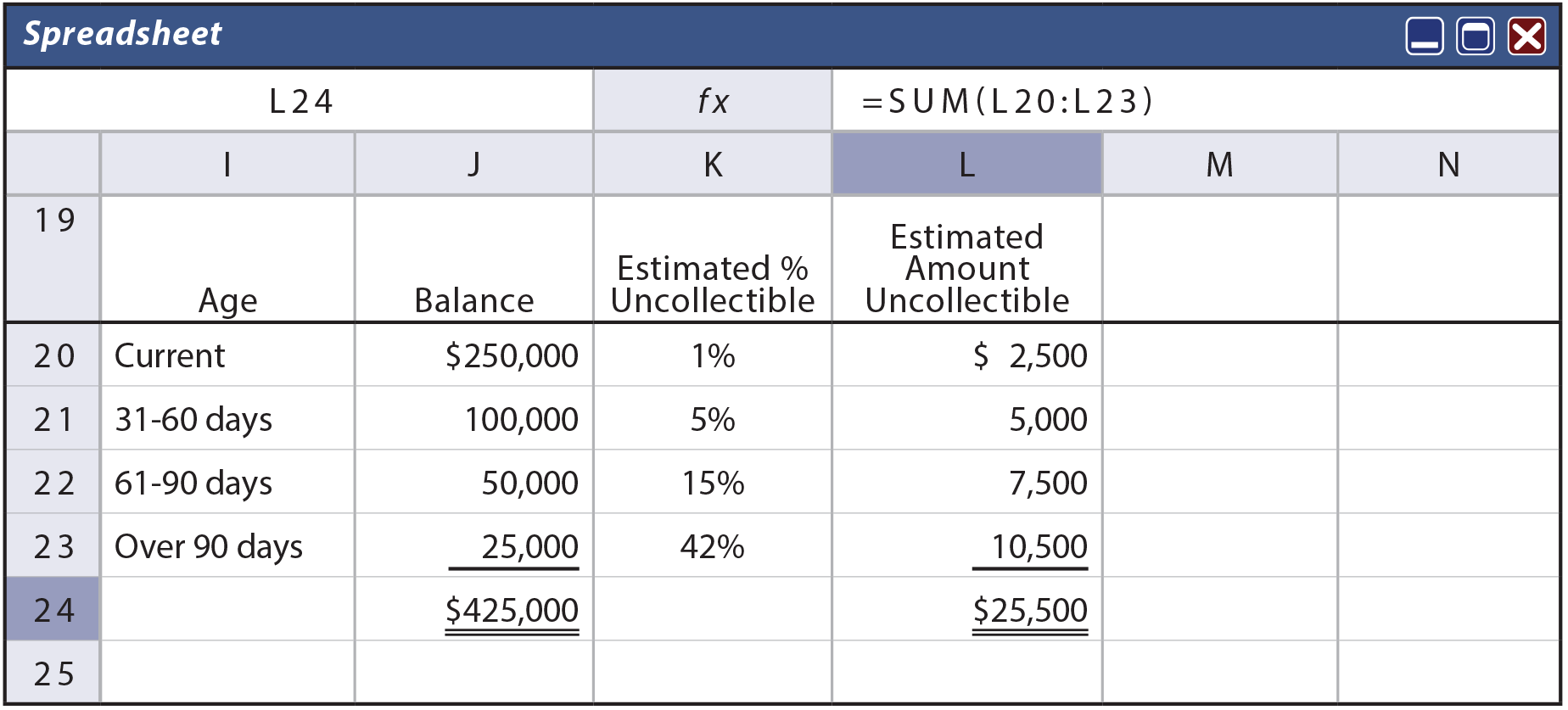

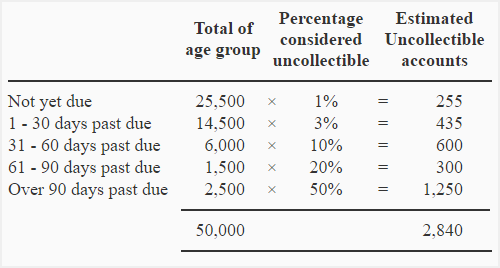

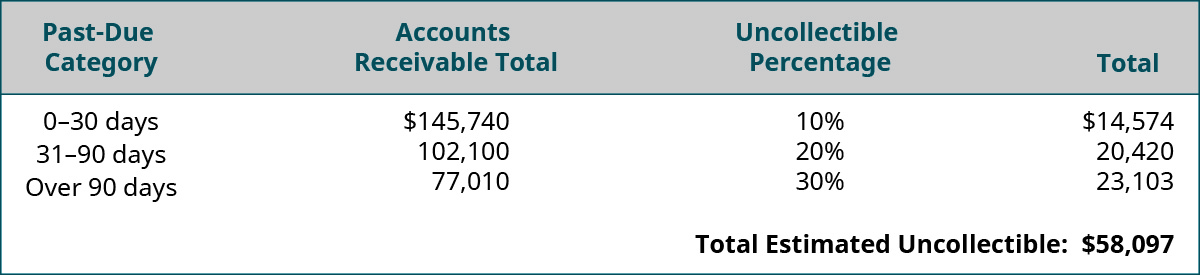

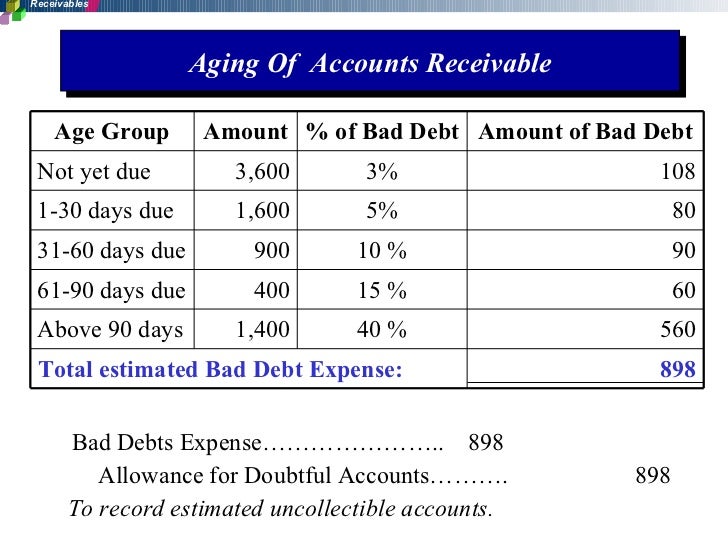

Aging of accounts receivable method. The aging method also referred to as balance sheet approach classifies accounts receivable into different age groups. Definition of aging method. The method to estimate the desired balance in the allowance account is called the aging of accounts receivable.

Explanation of aging method. Companies with accounts receivable do not always receive cash payments in full due to customers evading payments bankruptcy statutes of limitations on collections and other factors. The aging of accounts receivable method is used to determine bad debts or debts that are found to be uncollectable based on a set of criteria that will vary from one company to another.

According to this approach the longer the period for which an account receivable remains outstanding the lesser are the chances of its collection. The aging method usually refers to the technique for estimating the amount of a company s accounts receivable that will not be collected. The debit balance in accounts receivable minus the credit balance in allowance for doubtful accounts will result in the estimated amount of the receivables that will be converted to cash.

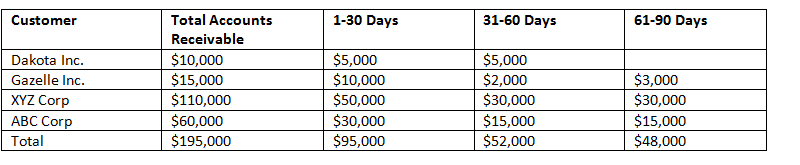

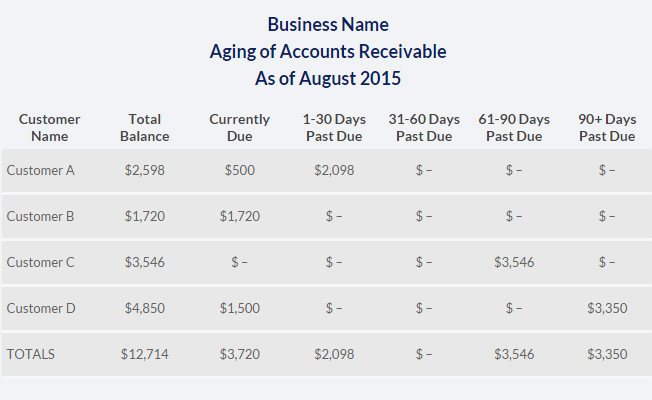

Categories such as current 31 60 days 61 90 days and over 90 days are often used. Accounts receivable aging is the process of distinguishing open accounts receivables based on the length of time an invoice has been outstanding. Accounts receivables arise when the business provides goods and services on a credit to the clients.

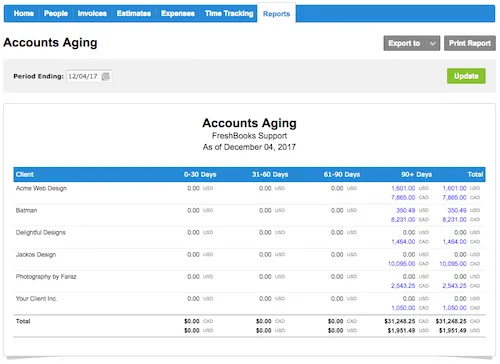

The accounts receivable aging december 23 2018 an accounts receivable aging is a report that lists unpaid customer invoices and unused credit memos by date ranges. In accounting aging of accounts receivable refers to the method of sorting the receivables by the due date to estimate the bad debts expense to the business. The aging report is used to collect debts and establish credit.

Accounts receivable aging sometimes called accounts receivable reconciliation is the process of categorizing all the amounts owed by all your customers including the length of time the amounts have been outstanding and unpaid. Accounts receivable aging is useful in determining. Accounts receivable aging is a technique to estimate bad debts expense by classifying accounts receivable of a business according to of length of time for which they have been outstanding and then estimating the probability of noncollection for each category.

The aging report is the primary tool used by collections personnel to determine which invoices are overdue for payment. Accounts receivable aging is a technique in accounting used to estimate bad debts under the allowance method and to improve control over unpaid invoices. This is done by dividing the balance in the accounts receivable account into age categories based on the length of time they have been outstanding.

The estimated amount that will not be collected should be the credit balance in the contra asset account allowance for doubtful accounts. You re aging this information.

What Is Accounts Aging And How Does It Help Your Small Business

What Is Accounts Aging And How Does It Help Your Small Business

Bad Debt Aging Of Accounts Receivable Method Youtube

Bad Debt Aging Of Accounts Receivable Method Youtube

Estimating Allowance For Doubtful Accounts By Aging Method Explanation Journal Entry And Example Accounting For Management

Estimating Allowance For Doubtful Accounts By Aging Method Explanation Journal Entry And Example Accounting For Management

Solved Pb8 1 Recording Accounts Receivable Transactions Using The 1 Answer Transtutors

Solved Pb8 1 Recording Accounts Receivable Transactions Using The 1 Answer Transtutors

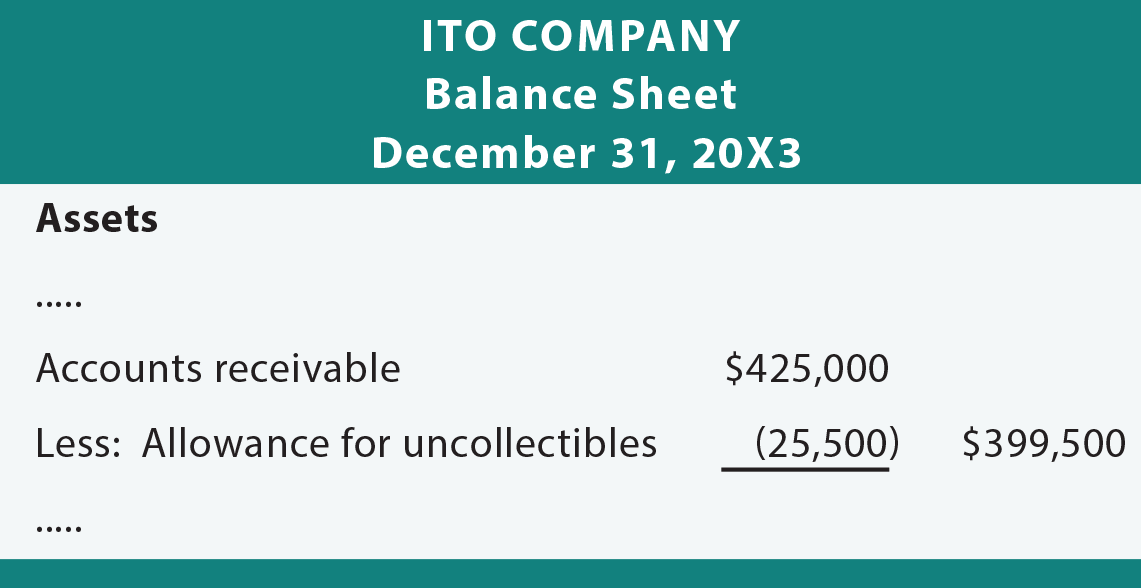

Receivables Chapter 8 Chapter 8 Explains Receivables Ppt Download

Receivables Chapter 8 Chapter 8 Explains Receivables Ppt Download

Accounts Receivable Aging Method Definition Allowance For Doubtful Accounts Bad Debts Expense Schedule Report Sample Example

Allowance Method For Uncollectible Accounts Double Entry Bookkeeping

Allowance Method For Uncollectible Accounts Double Entry Bookkeeping

Accounts Receivable Aging Definition

Aging Of Accounts And Mailing Statements Accountingcoach

Aging Of Accounts And Mailing Statements Accountingcoach

Receivables Bad Debt Expense And Interest Revenue Ppt Download

Receivables Bad Debt Expense And Interest Revenue Ppt Download

Accounts Receivable Aging Report The Ultimate Guide

Accounts Receivable Aging Report The Ultimate Guide

Accounts Receivable Aging Method

Which Of These Methods Is Required By Gaap Aging Of Accounts Receivables Percentage Of Credit Sales Either The Per Homeworklib

Which Of These Methods Is Required By Gaap Aging Of Accounts Receivables Percentage Of Credit Sales Either The Per Homeworklib

Solved 2 A Company Uses The Aging Of Accounts Receivable Chegg Com

Solved 2 A Company Uses The Aging Of Accounts Receivable Chegg Com

Allowance Method For Uncollectibles Principlesofaccounting Com

Allowance Method For Uncollectibles Principlesofaccounting Com

Accounts Receivable Aging Overview Uses Ar Aging Reports

Accounts Receivable Aging Overview Uses Ar Aging Reports

Aging Of Accounts And Mailing Statements Accountingcoach

Aging Of Accounts And Mailing Statements Accountingcoach

Accounts Receivable Aging Definition

Aging Method Of Accounts Receivable Uncollectible Accounts Play Accounting

Aging Method Of Accounts Receivable Uncollectible Accounts Play Accounting

Estimating Allowance For Doubtful Accounts By Aging Method Explanation Journal Entry And Example Accounting For Management

Estimating Allowance For Doubtful Accounts By Aging Method Explanation Journal Entry And Example Accounting For Management

Account For Uncollectible Accounts Using The Balance Sheet And Income Statement Approaches Principles Of Accounting Volume 1 Financial Accounting

Account For Uncollectible Accounts Using The Balance Sheet And Income Statement Approaches Principles Of Accounting Volume 1 Financial Accounting

Solved Assume Instead That Chipman Uses The Aging Of Acco Chegg Com

Mathematical Problem Aging Of Accounts Receivable Method Qs Study

Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcsmzvn4kc0t9j9zoc0sg 1exstjsgp1rvupp2zfl9cg8cj5zkna Usqp Cau

Aging Of Accounts Receivable Method

Aging Of Accounts Receivable Method

Aging Of Accounts Receivable Method Brandongaille Com

Aging Of Accounts Receivable Method Brandongaille Com

What Is Accounts Receivable Aging Report And How To Use It

What Is Accounts Receivable Aging Report And How To Use It

Allowance Method For Uncollectible Accounts Course Hero

Aging Of Accounts Receivable Overview For Business

Aging Of Accounts Receivable Overview For Business

Solved Exercise 3 Bad Debt Expense Using The Aging Of Ac Chegg Com

Solved Exercise 3 Bad Debt Expense Using The Aging Of Ac Chegg Com

Aging Method For Estimating Uncollectible Accounts Youtube

Aging Method For Estimating Uncollectible Accounts Youtube

Accounts Receivable Excel Quick Aging Report Using Excel Youtube

Accounts Receivable Excel Quick Aging Report Using Excel Youtube

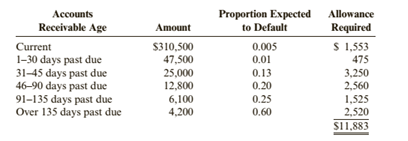

Bad Debt Expense Aging Method Glencoe Supply Had The Following Accounts Receivable Aging Schedule At The End Of A Recent Year The Balance In Glencoe S Allowance For Doubtful Accounts At The Beginning

Bad Debt Expense Aging Method Glencoe Supply Had The Following Accounts Receivable Aging Schedule At The End Of A Recent Year The Balance In Glencoe S Allowance For Doubtful Accounts At The Beginning

What Is Accounts Receivable Aging لم يسبق له مثيل الصور Tier3 Xyz

What Is Accounts Receivable Aging لم يسبق له مثيل الصور Tier3 Xyz

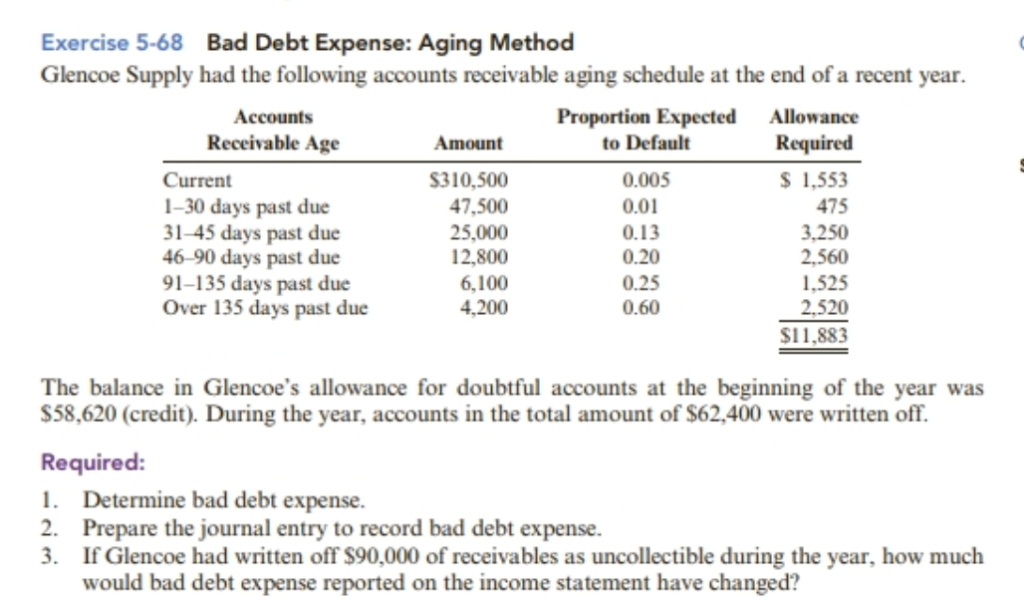

Answered Required Information The Following Bartleby

Answered Required Information The Following Bartleby

Allowance Method For Uncollectibles Principlesofaccounting Com

Allowance Method For Uncollectibles Principlesofaccounting Com

Unit Assesment 7 Prepare A Receivables Aging This Assessment Addresses The Following Course Objective S Record Various Homeworklib

Unit Assesment 7 Prepare A Receivables Aging This Assessment Addresses The Following Course Objective S Record Various Homeworklib

Posting Komentar

Posting Komentar